SoFi (Social Finance): aspire to be AWS of FinTech

SoFi is an online finance platform (neobank) that aims to provide a simple integrated solution to help customers manager their financial lives. In a short time period (last 2-3 years), SoFi has launched several financial products for Investing, Home Loans, School Loans, Credit Cards and SoFi Rewards.

There are many risks associated with this FinTech company (which we will discuss in later section), but let’s understand the business model first and also what makes it attractive for investment.

Mission - To help our members (HENWS - high earners not well served) achieve financial independence to realized their ambitions.

There’s a common playbook repeated by the best companies and the best CEOs. What they do is use technology to drive down the cost of delivering the killer product (like Apple started to do this with iPod, similarly in Autos, Tesla is in midst of driving this Winner Take Most outcome) and pass on those savings to consumers. As a result, consumers not only adopt that product at scale, but also gives the company permission to innovate and build many more products on top of the same common infrastructure.

That’s the playbook SoFi wants to build in financial services. SoFi sees that current large financial institutions, through a combination of very strict regulation as well as extremely old legacy technology, has been very much handcuffed. In doing so, consumer dissatisfaction has continued to go up, NPS has continued to go down, and in some cases have gone negative. In many ways, what’s happened is that these companies have stopped giving consumers the value that they need.

In contrast, SoFi has been building -

One-stop shop for customers to help organize their financial life in a way that gives a sense of safety and security for the future.

Why SoFi? - key points of differentiation

Fast - fastest way to do everything (apply for & borrow money, open an account, buy/sell stocks, deposit checks/access cash, pay a friend/bill)

Selection - broad array of products across member lifecycle (unique terms, features & services, personalized with member benefits)

Content - to help members GYMR (get your money right), via both SoFi & Non-SoFi brands (education, information, advice, credit score, investment research)

Convenience - provide the most convenient experience (ease of use, any time, any platform, any place, simplicity)

A team that really understood how to build best-in-class consumer apps and websites.

Business focus in terms of their initial customers - start with high creditworthy customers, build a great lending practice with low losses and high predictability, and then offer that product suite to every single person.

Build a company with Winner Take Most Outcome - a FinTech company that could use the consumer business as a Trojan horse to also build a best-in-class Enterprise business — AWS of FinTech

Overview

SoFi is systematically dismantling more than $2 trillion of market cap that is held by all the traditional baking companies, which got lot of regulatory oversight and technology that is in some cases, 50, 60 and 70 years old.

On the consumer lending business, launched many successful products on top of their first hero product - student loan refinance business - last six quarters of sequential quarter-over-quarter growth. Offers - student loan refinancing, personal loans, home loans, in-school loans.

By the end of 2021, SoFi forecast to have more than three million members. Along the way, with those millions of members, what they are finding is this virtuous cycle in their ability to cross-sell and upsell these new products at low or no cost of acquisition. For example, look at home loans, when SoFi created that product, they were able to upsell that to existing members. What they found out was two-thirds of the new home loan sales came from existing members - zero customer acquisition cost (CAC).

Source: Investors Presentation SoFi is in an incredibly unique position where almost one in four of all new product sales come from existing members. In fact, in 2021, there’ll be more than four million products sold to their members.

MOAT - SoFi is using personal, financial and behavioral data of millions of customers to build better risk models and launch new products for customers.

SoFi is responsible today for more than 90% of all the new account creation amongst all the neobanks in the United States

On the Enterprise side, SoFi provides -

A platform for companies to assist their employees to achieve financial goals (its like a suite of services to company to spread to employees)

Galileo (Technology Platform) - powers payments for several big-name fintechs, including stock trading app Robinhood, money transfer service TransferWise and digital bank Chime. Using APIs, or code that clients can access and customize, it helps businesses launch financial services including debit cards and bank accounts, POS authorization, bill pay, direct deposit, etc. This clearly shows SoFi’s ambition to become a highly diversified financial services business.

Financial Services - offers SoFi Invest, SoFi Money, SoFi Credit card, SoFi Lantern, SoFi Relay, SoFi Protect

Invest - offers two types of investing: active stock trading (including fractional shares and cryptocurrency) and a passive, robo-adviser option.

Protect - SoFi Fills Out Insurance Offerings Together with Lemonade and Root

Lantern - is a product comparison site that makes it easy for individuals to shop for products and compare offers with top lenders. Lantern is owned and operated by SoFi Lending Corp.

Relay - tracks all of your money, all in one place. Get credit score monitoring, spending breakdowns, financial insights, and more - at no cost.

All the business segments are at different stages in their growth trajectory & lifecycle.

Business Strategy

Land and Expand strategy at SoFi - build loyalty with product-1 (e.g., student loan), next build product-2 (e.g., home loan) that flow well with product-1. For example, when students graduate they will apply for home loans so SoFi will have advantage of cross-selling home loans to existing members, thereby saving on customer acquisition cost (CAC).

Financial projection by the company

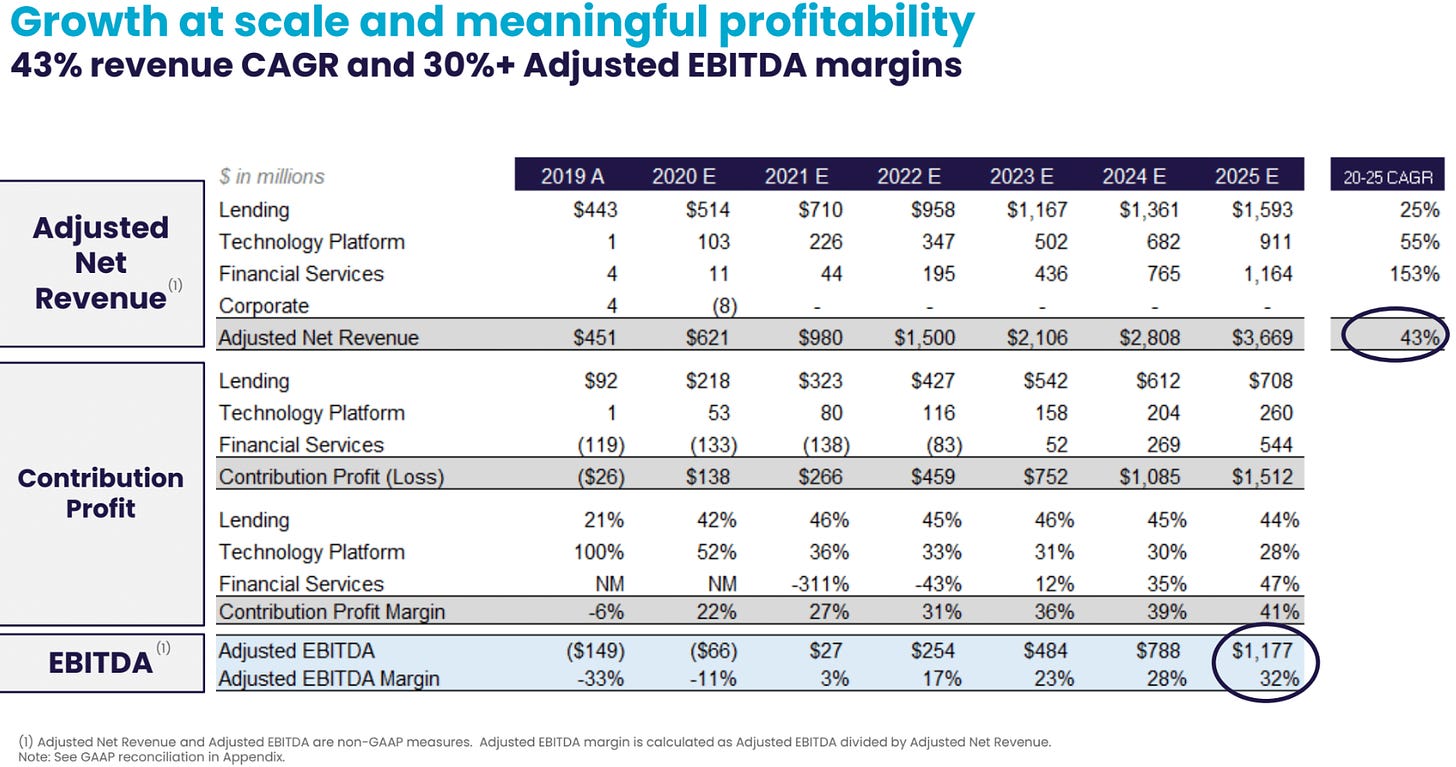

By 2025, SoFi projects revenue of $3.7 billion, that’s a five-year compounding of 43% CAGR.

In 2021, SoFi projecting $27 million of EBITDA, and by 2025 that will grow to almost $1.2 billion. That represents is an EBITDA margin of almost 33%.

SoFi has diversified revenue stream projection by 2025

2020E adjusted revenue composition (total $621M) - 63% Lending, 17% Tech Platform, 2% Financial Services.

2025E adjusted revenue composition (total $3.7B) - 43% Lending, 25% Tech Platform, 32% Financial Services.

Bank charter

SoFi is in the process of obtaining its banking license, which would benefit its lending business, and also Financial Service business. SoFi estimates impact to be significant -

Bank charter will enable - lower cost of capital, more net interest margin from longer loan holding periods, and boost to lending growth.

Management

CEO - Anthony Noto (owns 1% of SoFi). Previously - COO & CFO at Twitter.

CFO - Chris Lapointe (previously - Global Head of FP&A at Uber)

CMO - Lauren Stafford Webb (from Intuit)

53.7% of shares are held by within the organization - board members & management

Glassdoor rating of management

Going public

SoFi has agreed to a business combination with a SPAC. Social Capital Hedosophia Holdings Corp. V (IPOE) is the next Chamath Palihapitiya SPAC to form a business combination with a strong company. The deal will take few months to close.

So far, Chamath has successfully selected target companies leading to value creation for investors buying into the SPACs early. The latest deal involves IPOE combing with SoFi at a transaction equity value of $8.65 billion (=$10 per share * 865million of outstanding shares). The deal leaves the fintech with $2.4 billion of cash proceeds via a $1.2 billion PIPE, up to $805 million of cash held in the trust account and another $370 million via a T. Rowe investment. In total, the enterprise value was estimated at $6.6 billion.

$8.7 billion of post-transaction equity value represents a 20 times 2023 P/E multiple, or a nine times 2025 P/E multiple. To put this in context, companies like JPMorgan, Bank of America, Goldman Sachs, today trade on an average of an 11 times P/E, except those businesses grow on a five-year basis, around 3%. This deal at 9 times for a business that’s growing at 43%, so more than 15 times better.

Valuation

IPOE shareholders will get 9.3% of SoFi along with 2.3% of IPOE sponsor. IPOE last closing price (15-Jan-2021) was $20.16 making market cap of $2.03 billion. This implies valuation of SoFi to be at $17.5 billion (=2.03/(9.3%+2.3%)).

$17.5 billion of current valuation is equivalent to 28x price-to-sales for 2020 (sales $0.621 billion) and 4.8x price-to-sales for 2025 (for projected sales $3.669 billion).

Risks

Too many players - fintech entrants are abundant. Biggest competitors are Square & PayPal.

>> Market size is too huge for more than 1 player to exist in the market. Second, it depends on SoFi management team to execute well and acquire customer base which fully rely on SoFi suite of products only.

Also, International expansion (for neobanks) are relatively easier and faster, which will boost revenue further.Management projecting big growth numbers - will need to be monitored very closely.