Okta - leading Identity Management Platform for the Enterprise

Qualitative

Leading identity management platform for the enterprise.

Okta’s two co-founders, Todd McKinnon and Frederic Kerrest, still run the company. Prior to founding Okta in 2009, they both worked at Salesforce (CRM). Todd ran engineering there and Frederic focused on sales and business development. As Salesforce and other companies were emerging in the SaaS space, the two saw a need to securely manage access to all these apps for enterprises. Out of this, Okta was born. Okta is headquartered in San Francisco.

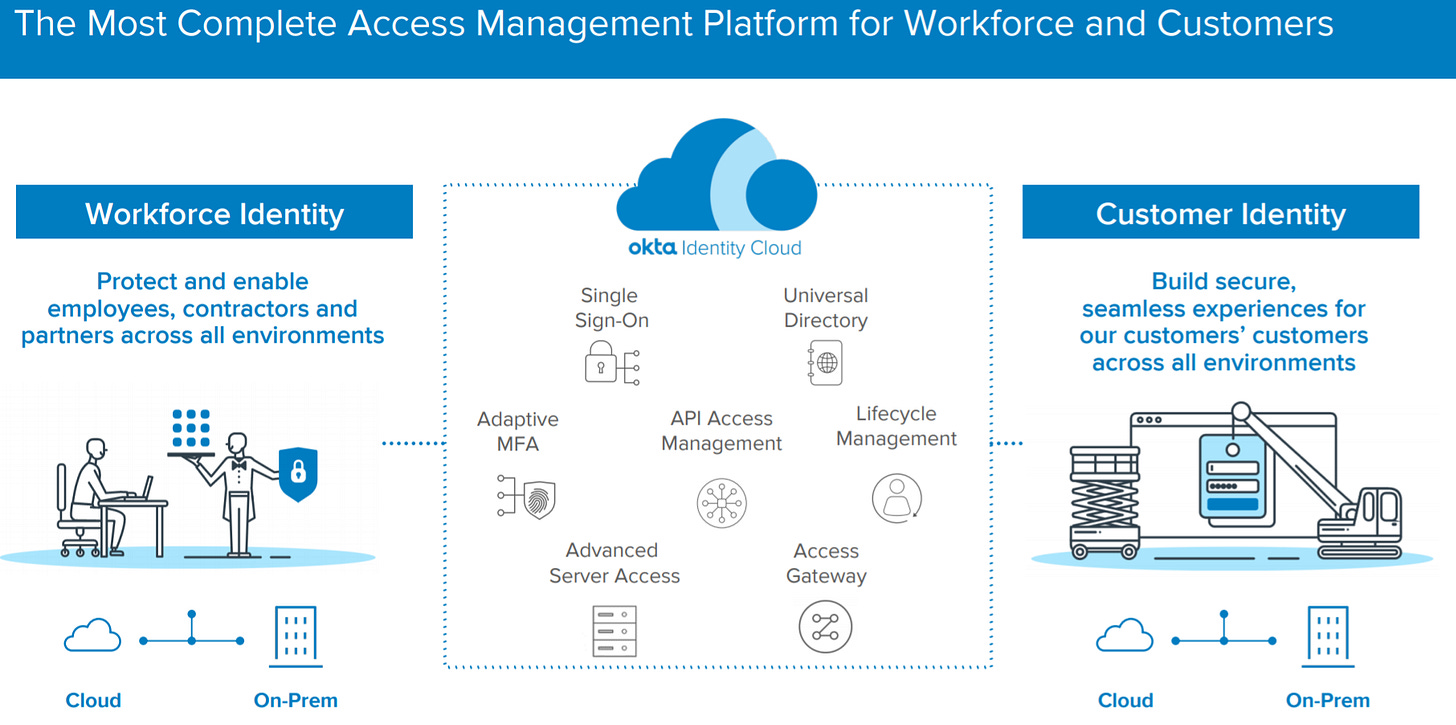

Okta Identity Cloud (OIC) enables customers to securely connect the right people to the right technologies at the right time. It helps organizations effectively harness the power of cloud, mobile and web technologies by securing users and connecting them with the applications they rely on. OIC is used by organizations in two distinct and powerful ways - (1) manage & secure their employees, contractors and partners (which is referred to workforce identity) and (2) manage and secure identities of their own customers (known as customer identity).

Growth drivers for Okta -

Cloud adoption and Hybrid IT - more and more companies have shifted to hybrid cloud and public cloud infrastructure and are now relying on connected devices and distributed workforce.

Digital transformation

Zero Trust security - according to Marketsandmarkets, zero trust security market size is projected to grow from USD 15.6 billion in 2019 to USD 38.6 billion by 2024, at a CAGR of 19.9% from 2019 to 2024.

Customers are choosing Okta driven by (1) independent and neutral platform for workforce identity (vendor neutral - security provider to be different than cloud provider), (2) scalable and secure customer identity platform, and (3) identity centric approach to Zero Trust security.

Business model -

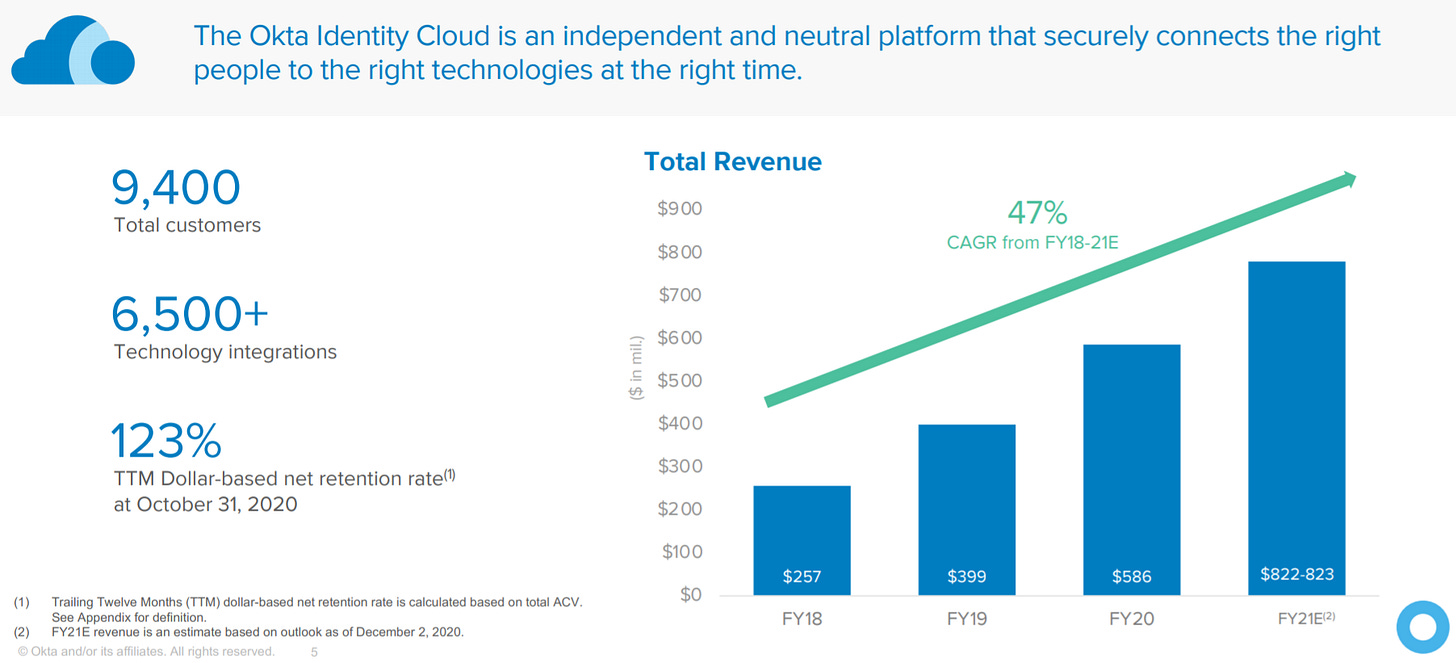

Okta employs SaaS business model and generate revenue primarily by selling multi-year subscriptions to cloud-based offerings. Focus on acquiring and retaining customers and increasing their spending through expanding the number of users who access their platform and up-selling additional products — land & expand strategy. This is evident from Okta’s dollar-based net retention rate ~123% (measures ability to increase revenue across existing customer base through expansion of users and products associated with a customer as offset by churn and contraction in the number of users and/or products associated with a customer).More details on Okta products can be referred here.

Growth Strategy employed by Okta -

drive new customer growth (using land-and-expand sales model),

deepen relationships within existing customer base (cross-selling and up-selling additional and new products),

expand channel partner ecosystem (expand indirect sales network)

expand international footprint (only 16% of revenue is generated outside of US in fiscal 2020, gives significant opportunity to grow international business)

Moat - (1) Network effect and (2) Vendor neutrality are the key differentiators for Okta. The Okta Integration Network (OIN) contains over 6,500 integrations with cloud, mobile and web applications, IoT devices and IT infrastructure providers, including Amazon Web Services, Atlassian, Cisco, F5 Networks, Google Cloud Platform, Microsoft Office 365, NetSuite, Oracle, Palo Alto Networks, Proofpoint, Salesforce, SAP, ServiceNow, Slack, Splunk, VMware, Workday and Zoom. At the core of the Okta Integration Network is a patented technology that allows our customers to seamlessly connect to any application or type of device that is already integrated into Okta network.

As more and more customers use Okta's offerings for a range of use cases, the company gets insights about application usage trends and security threats. Hence, developers can expect further improvement in security offerings. Also, the network effects are a solid entry barrier for new players even if the latter price the products below Okta's pricing levels. This is because businesses are well aware of the importance of security solutions and prefer to choose more experienced players even at a higher price.

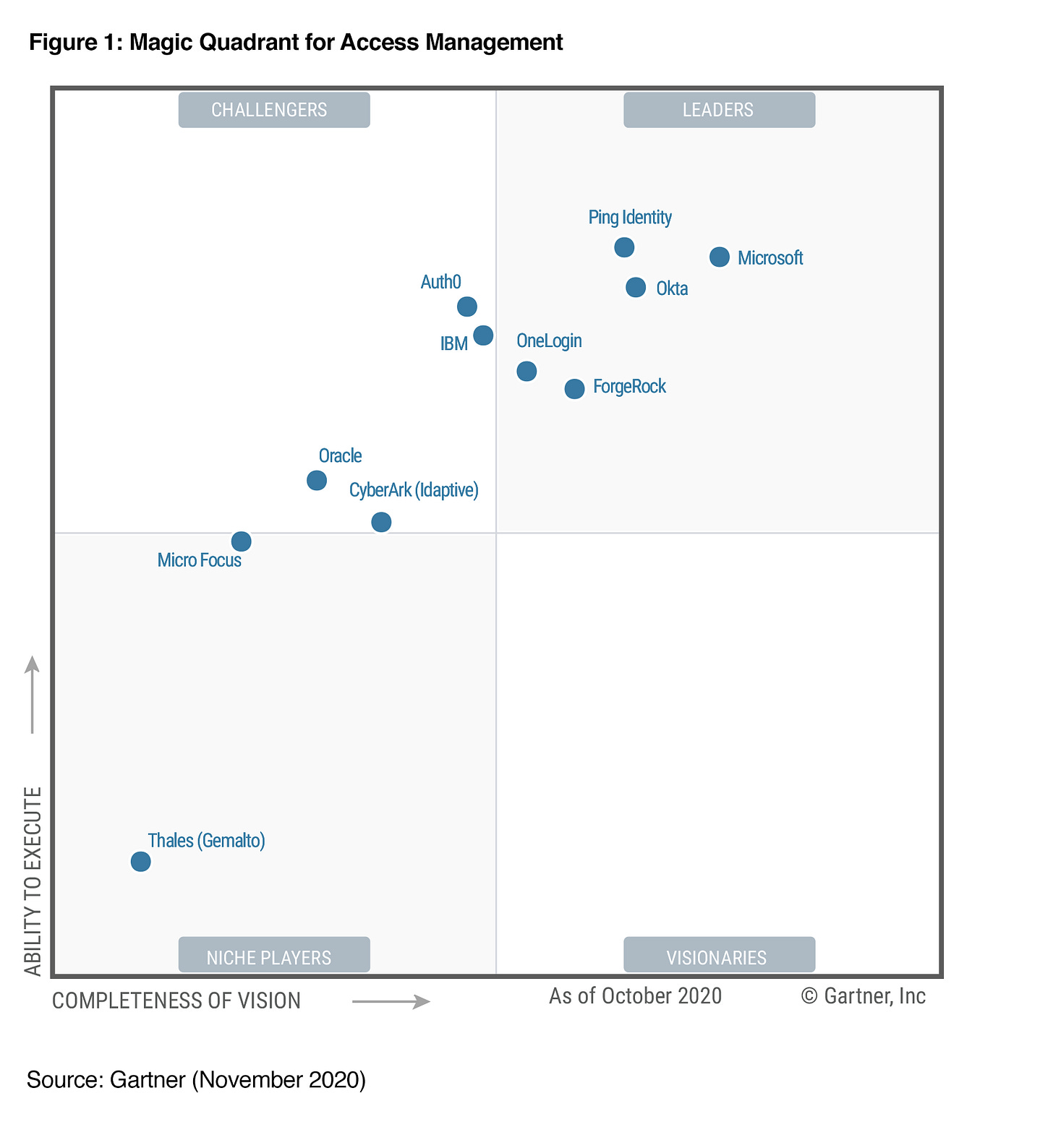

Competition -

In the most recent Gartner Magic Quadrant published in November 2020, Okta was placed in the Leaders quadrant, together with Ping Identity and Microsoft.Microsoft is the real threat to Okta business. Microsoft has been in the access management space for a long time. As part of its go to market strategy, Microsoft bundles Azure AD with Office 365. This provides the user login capability for Office 365 products. According to Okta, there are some of the limitations of Microsoft solution as highlighted here.

While Okta seems to be downplaying Microsoft’s capabilities, Microsoft appears to be continuing to evolve their AD solution quickly. For example, at one point Okta leadership mentioned that Azure AD doesn’t support SSO for popular collaboration apps, but I can find most listed in the App Marketplace at this point. Also, Microsoft’s AD blog is active, with frequent product updates.

Microsoft claims to have 90% of the Fortune 500 using Azure AD due to its automatic deployment with Office 365. If Microsoft really embraces neutrality and invests heavily in AD as a stand-alone solution, it could generate more friction for Okta.Ping Identity was founded in 2000 and is headquartered in Denver, CO. They are a provider of identity and access management software, with heavy enterprise penetration. They claim to have secured over 1 billion identities and to serve over 1,500 customers.

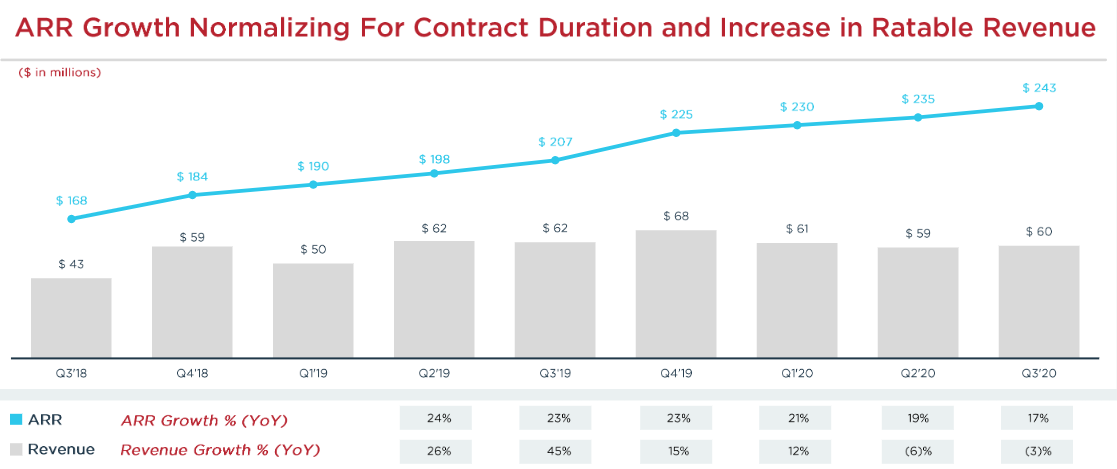

Due to variance in revenue recognition, Ping Identity leadership prefers that investors look at ARR growth, instead of revenue. ARR growth for prior year was 23% and looking forward to FY2020 is estimated at 18%. Still about half of Okta’s revenue growth rates.Ping Identity positions their product offerings in a similar way as Okta, addressing both Customer Identity (for the enterprise’s customers) and Workforce Identity (for the enterprise’s employees). Their software delivery model supports three deployment postures – On-premise, hybrid and cloud.

Ping has an impressive list of customers, claim to 60% of the Fortune 100.Ping is much smaller than Okta in terms of revenue and is growing at half the rate.

Ping Identity partnership with Microsoft - Ping has an extended partnership with Microsoft in which its products are offered as part of the Azure AD Premium. Microsoft customers can use Ping solutions to connect to Microsoft Azure or Office365 services. They also enable non-Microsoft applications and environments to be easily integrated into the Microsoft ecosystem. This relationship might lead to an acquisition by Microsoft in the future. The combination might represent a more meaningful threat to Okta.

Quantitative

Okta calculates its TAM at ~$55bn divided across Workforce Identity TAM $30bn and Customer Identity TAM $25bn.

Workforce Identity TAM $30bn based on over 50,000 US businesses with more than 250 employees multiplied by 12 months ARR assuming adoption of all current products, which implies a market of $15bn domestically, then multiplied by 2 to account for international opportunity.

Customer Identity TAM $25bn based on 4.4bn combined Facebook users and service employees worldwide multiplied by internal application usage and pricing assumptions.

Customers - as of Dec 2nd, 2020, Okta got 9,400 customers, including more than 1,780 customers with an annual contract value greater than $100,000. Customers span nearly all industry verticals and range from small organizations with fewer than 100 employees to companies in the Fortune 50, with up to hundreds of thousands of employees, some of which use the Okta Identity Cloud to manage millions of their customers' identities.

Revenue - Okta is a growth company, revenue growing 47% CAGR for FY18-21E.

“Rule of 40” — total revenue growth plus free cash flow margin.

Valuation - Okta is trading at P/S ratio of 45.71 as of Feb 2021. Lofty valuations expose share prices to significant downside risk even in the event of single unfavorable news or earnings miss. Competition from Microsoft, Ping Identity and other private players may also affect the company's future growth rates. However digitization is here to stay and grow, this means more demand for security solutions.