Mohawk Group - leading tech enabled consumer products platform

Overview

Mohawk is a rapidly growing technology-enabled consumer products company. Mohawk was founded on the premise that if a CPG (consumer product groups) company was founded today, it would apply A.I. and machine learning, (1) the synthesis of massive quantities of data and (2) the use of social proof to validate high caliber product offerings as opposed to over-reliance on brand value and other traditional marketing tactics. — S-1 filing

Company is reinventing how to rapidly and successfully identify new product opportunities and to launch, autonomously market and sell products in the rapidly growing global e-commerce market by leveraging proprietary software technology platform, known as AIMEE (Artificial Intelligence Mohawk e-Commerce Engine). AIMEE combines large quantities of data (from various e-commerce platforms, the internet and publicly available data), A.I., machine learning and other automation algorithms, at scale, to allow rapid opportunity identification and automated online sales and marketing of consumer products.

Mohawk calls out in its Dec 2020 Investor presentation that “Data-driven Consumers look beyond Brand Loyalty”. To drive the most value from a product, shoppers are driven by data using a mixture of - (1) Product Reviews, (2) Store-to-Store pricing, and (3) Social Media Sources.

Over half of millennials, 51%, have no real preference between private-label and national brands

Only 22% of searches on Amazon include a brand name

Business model

Mohawk calls it business model as combination of CPG, eCommerce, and Technology.

Mohawk Group was founded in 2014. It builds and launches products from the grounds up using proprietary data to help inform and validate its decisions. It also acquires other top brands without adding significant fixed costs as part of its M&A strategy.

5 brands launched and 6 brands acquired

280+ SKUs; 40 new product launches LTM Dec 2020

Mohawk Go-To-Market Timing - significantly faster

Mohawk manages to cut down on development and production time, boost the speed and impact of its marketing all while rapidly finding new take-over targets. Mohawk’s go-to-market takes 6 to 8 months versus 1.5 to 2 years for conventional CPGs.

AIMEE (AI Mohawk eCommerce Engine)

AIMEE automates and optimizes the performance of consumer products

Research - automate research that utilizes live market data to track exposure and product trends to quickly discover new market and product opportunities.

Financial planning and analysis - track new product planning, inventory levels, media buying spend and more. Data insights are in one place, enabling execution across multiple channels.

Trading - trading engine built to implement automated marketing strategies and learn through experimentation. The result is an algorithmic solution optimized for live decisions to scale sales.

Logistics - manages fulfillment and supply chain logistics to enable faster delivery of products to consumers.

Using data and analysis provided by AIMEE, company determines which products to market, manufacture through contract manufacturers, import and sell on eCommerce marketplaces. Company contract manufacturers, through purchase orders, predominately in China, for consumer products. Company employees in China perform sourcing, product testing, manufacturer qualification, quality assurance and control and purchasing, among other things. Company take ownership and import these goods from China through various transportation methods via third party transporters. Company uses a combination of Amazon warehouses, other third-party warehouses and logistics partners to fulfill direct-to-consumer orders through agreements or terms of services. Sales, marketing and fulfillment are substantially integrated into AIMEE, which allows to automate price, media buying, search engine optimization and shipping.

Each products goes through three phases -

Launch phase - during this phase, leverage technology to aggressively price and market products, targeting opportunities identified by AIMEE. During this period of time and due to the combination of discounts and investment in marketing, net margin for a product could be as low as negative 35%. Net margin is calculated by taking net revenue less cost of goods sold, less fulfillment, online advertising and selling expenses.

Sustain phase - goal is for every product launched to enter the sustain phase and become profitable, with a target average of positive 10% net margin, within three months of launch. Net margin reflects automated adjustments in price and marketing spend.

Milk or Liquidate - if a product does not enter the sustain phase or achieve profitability at each transaction or if the customer satisfaction of the product (i.e., ratings) is not satisfactory, then it will go to the liquidate phase and will sell the remaining inventory. In order to enter the milk phase, we believe that a product must be well received and become a leader in its category in both customer satisfaction and volume sold as compared to its competition. Products in the milk phase that have achieved profitability should benefit from pricing power and we expect their profitability to increase accordingly.

Currently none of the products have achieved milk phase, and operating results include a mix of products in the launch and sustain phases. Ultimately, company believes that the future cash flow generated by its products in the sustain phase will outpace the amount that will be reinvested into launching new products, driving profitability at the company level while company will continue to invest in growth and technology.

AIMEE is delivering results

Number of products with $500K+ annual sales - 21 products in 2018, 37 products in 2019, 67 products in 2020 (CAGR of 78%)

Average review score for all Mohawk products is 4.4 out of 5.0

110 products in the top 5 search results in Amazon

Top 20 products - average review count keep increasing year-over-year - 923 reviews in 2018, 1203 reviews in 2019, and 3662 reviews in 2020.

M&A strategy

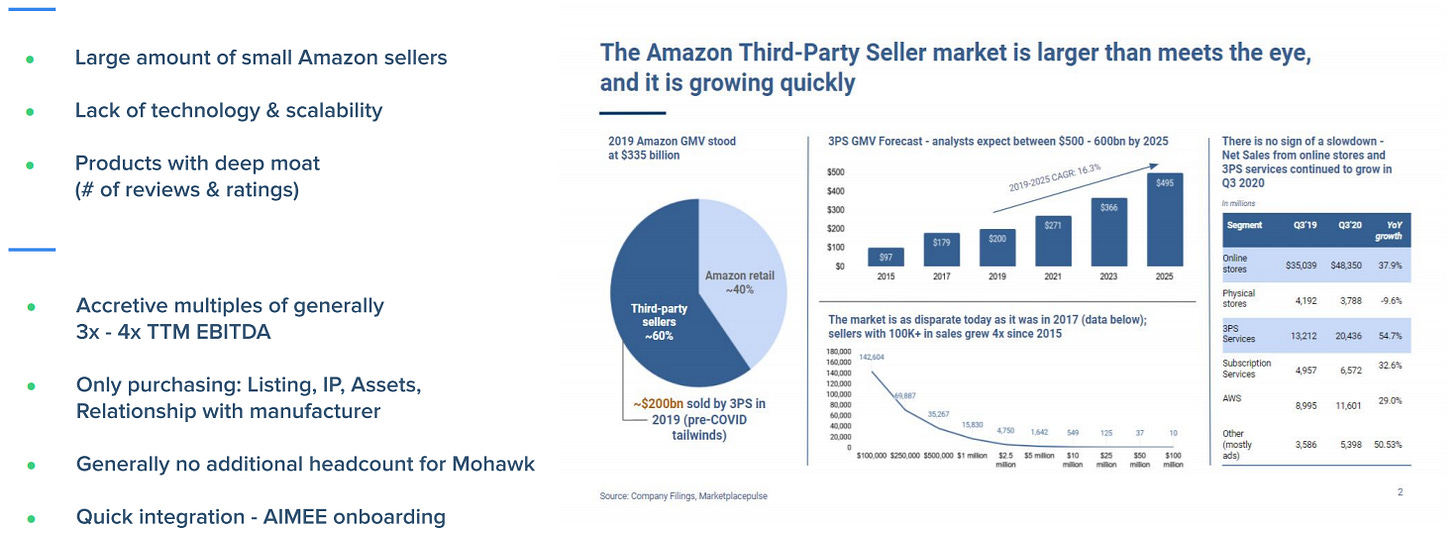

Mohawk’s data driven approach also enables it find best-selling merchants and buy these over as they lack the technology and scalability Mohawk has built over time. These acquisitions keep Mohawk asset light as it only acquires the listings, IP, assets and manufacturers relationships.

Market opportunity

Massive and rapidly expanding market - worldwide eCommerce sales expected to grow to $8.1tn in 2025 from $4.4tn in 2020.

Mohawk believes that their data-driven approach, powered by AIMEE, position them for success to address these structural shifts as consumers move to digital marketplaces to satisfy their needs.

Company believes that traditional brick-and-mortar CPG industry has been slow to react to changing consumer needs in the digital age. In addition, smaller digital native brands, brands whose products are only sold online, are also taking market share from traditional incumbent consumer product companies. Digital native brands that sell direct-to-consumer with competitive pricing and product features, meanwhile, can garner significant social proof in the form of reviews and have deeper relationships with their consumer base. Also, the consumer journey is data-driven and no longer relies primarily on brand value to drive buying decisions.

Strength

Continue optimizing product economics by lowering manufacturing and logistics costs through increased purchasing power

Pursue higher value products and larger product markets

Opportunistically add new products and categories through acquisition

Expand to international and new domestic eCommerce marketplaces

Monetize AIMEE platform by providing access to third party brands

Management team - deep experience in eCommerce, CPG, & Tech

Due Diligence w/ CEO Yaniv Sarig: How Mohawk [MWK] is Disrupting CPG (CEO Interview)

Financials

Balance Sheet

Income Statement

Valuation

Guidance by management -

$MWK is expected to close 2020 with projected Sales of $185M, which is 60% YoY growth. Management has given guidance of $320M revenue for 2021 (70-80% YoY growth), if this comes true then at current Market Capitalization of $450M, $MWK is trading at ~1.4x NTM (next twelve months) sales. For context, Kraft-Heinz trades at 2.7x NTM, P&G trades at 4.9x NTM, Canpbell Soup trades at 2.4x NTM.

Given the strong business model, go-to-market strategy, AI-driven product strategy, and expansion across products & geography - Mohawk got potential to be trading at 10x 2021 sales, which will put it at market cap of ~$4bn, which will be 10x from now. Mohawk is clearly getting benefit from the eCommerce trend and available currently at much lower valuation as compared to some other eCommerce players.

The price at which this company is trading, either looks like a huge bargain or biggest scam.

Risks

Amazon decides to kick Mohawk from the platform or limit availability to necessary info

>> AIMEE engine runs on predominately on customer facing data such as product listings and reviews. If Amazon eliminated then they would be severely hurting themselves. 3rd party sellers now make up 60% of sales of Amazon.Chinese manufacturing, trade war with US

>> With Trump leaving office and Biden joining, this doesn’t seems to be a big risk. If Mohawk has to deal with it that means everyone does.Inability to pivot to other platforms

>> Company needs to penetrate to other markets through different platforms, so it will be critical to launch on other platforms/marketplace.