Please note that this article does not constitute investment advice in any form. This article is not a research report and is not intended to serve as the basis for any investment decision. All investments involve risk and the past performance of a security or financial product does not guarantee future returns. Investors have to conduct their own research before conducting any transaction. There is always the risk of losing parts or all of your money when you invest in securities or other financial products.

Lemonade is a InsurTech company. It is rebuilding insurance from the grounds up on a digital substrate and an innovative business model. By leveraging technology, data, artificial intelligence, contemporary design, and behavioral economics, Lemonade is making insurance more delightful, more affordable, more precise, and more socially impactful.

Business model

Unlike any other insurance company, Lemonade gain nothing by delaying or denying claims (take a flat fee, currently 25%), so it handle and pay as many claims instantly as possible. Traditional insurance companies make money by keeping the money they don’t pay out in claims. This means whenever they pay claim, they lose profit. This is why getting claims paid fast and in full is sometimes so hard.

Lemonade is built differently. In essence, it treat premiums as if they were still policyholder's money and return unclaimed remainders during its annual 'Giveback' (unique feature of Lemonade, where each year leftover money is donated to causes policyholders care about).

Policies in Depth - Lemonade sells 75% of risk to "Reinsurers". It cedes 75% of their premiums to these Reinsurers. In exchange, Reinsurers pay Lemonade a 25% "Ceding commission".

Why? - It is a transfer of risk (kind of stop loss). Insurance companies generally have predictable top line revenue but potential bottom line volatility (due to line risk, large payouts, natural disasters, terrorism, etc.).

Lemonade’s new re-insurance contracts free them up from capital requirements which are great and reduces their margin volatility. For every $100 dollar of premium written, they cede $75 to reinsurers, who in turn pay a $19 commission back to Lemonade (25%). This means the reinsurers are working on a gross margin of just over 6%. When a claim arises, both the carrier and the reinsurers pay proportionately. So, based on an expected 70% loss ratio, for every $100 in premium, expect $70 in losses. The reinsurer would pay $52.5 and Lemonade $17.5. This arrangement leaves Lemonade with approximately $27 for all other expenses and profit.

Threat - If rates (loss ratio) become unreasonable, then (1) Lemonade must assume more risk Or (2) Manage risk will result impacting volume & therefore impacting profit.

Strategy - Transparency, Delight Customers

Delighted customers fuel growth, growth spawns predictive data, data powers the machine learning that improves performance, to the delight of consumers. Wash, rinse, repeat.

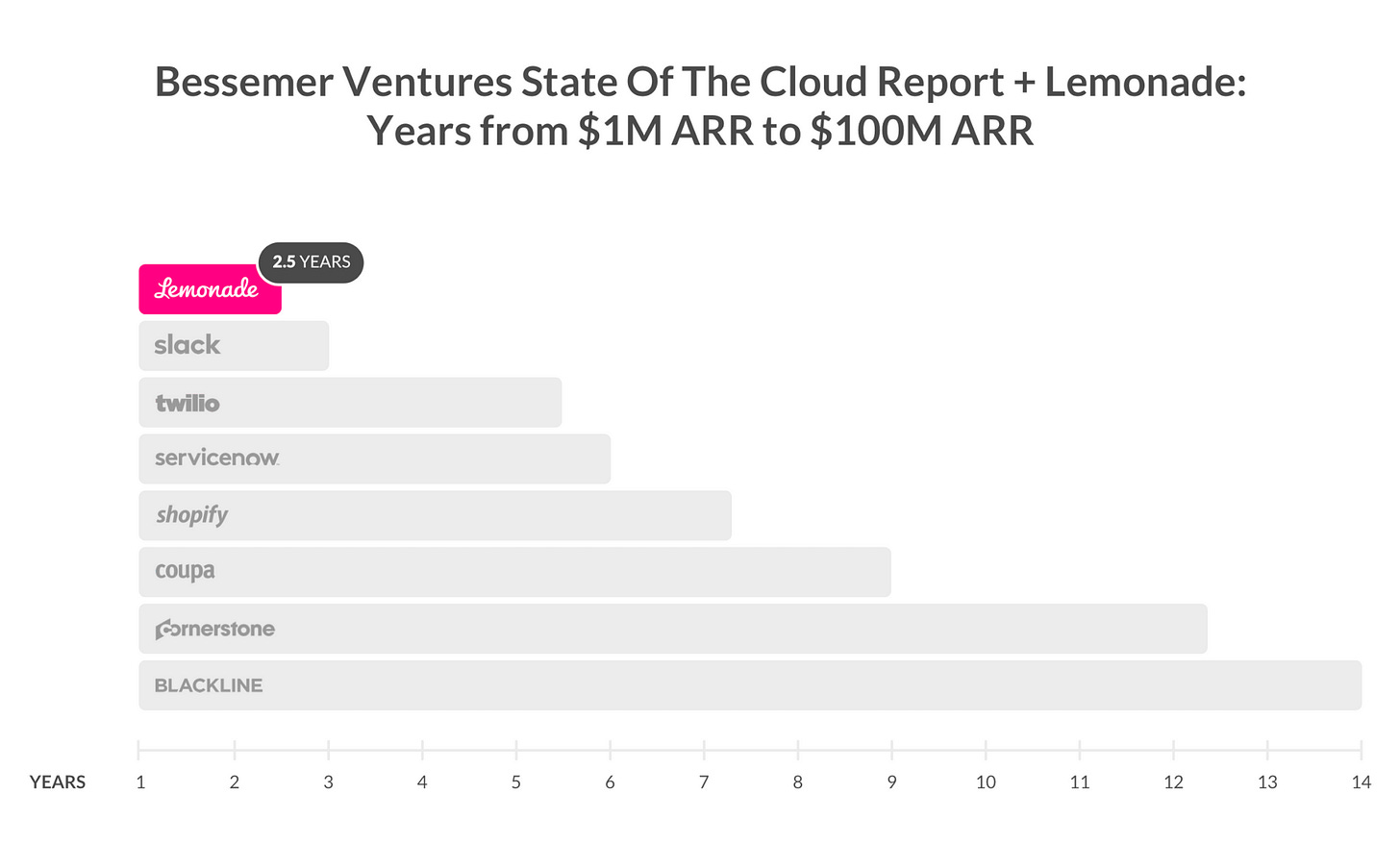

In 2019 ‘State of the Cloud’ report, Bessemer Ventures shared a benchmark for how many years it takes ‘Good’, ‘Better,’ and ‘Best’ tech companies to grow from $1m in annual recurring revenue – known as ARR – to each of $10m and $100m.

Let's understand the reason for such a high growth..

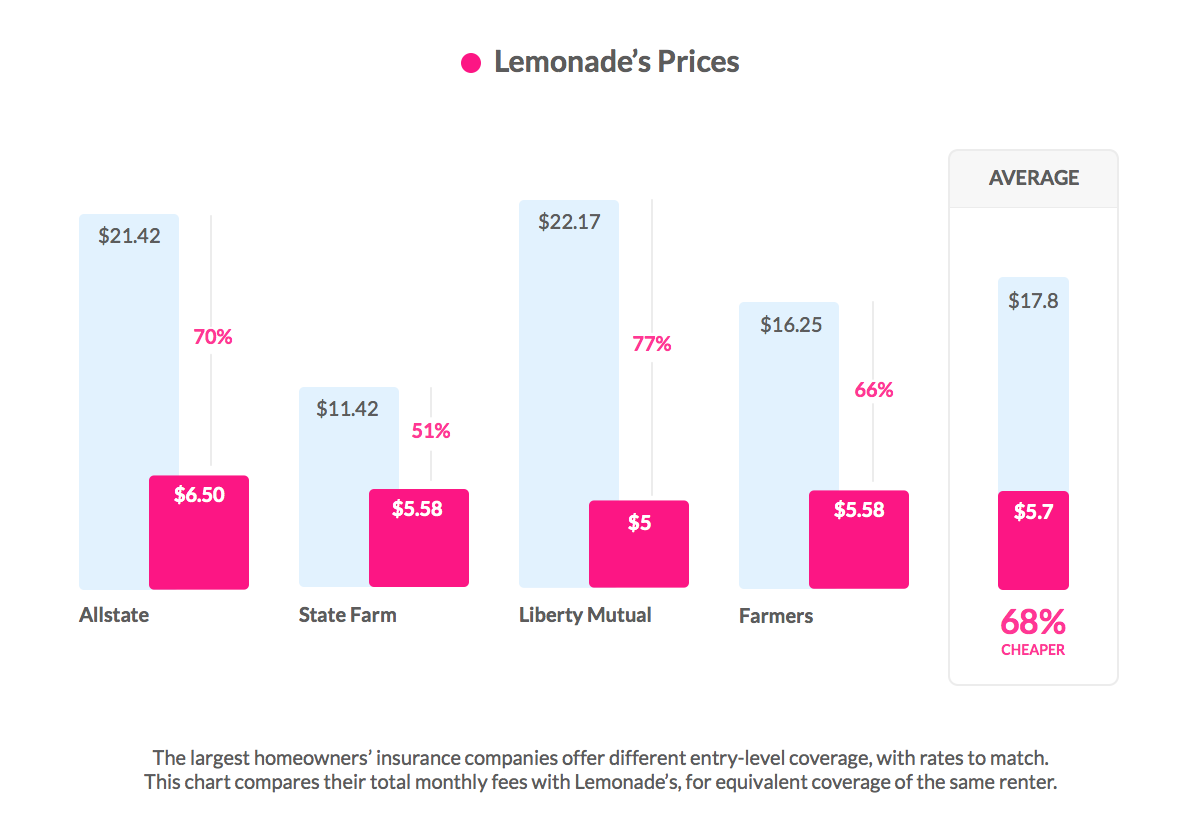

As per Lemonade study, it charges 80% less (same as saying others charge 5x more). However it may mean that Lemonade will be paying out in claims more than it receives in premiums. Does it mean Lemonade is recklessly naive, and insolvency just a matter of time.

Due to Lemonade unique business model, powered by AI and behavioral economics (no brokers), Lemonade acquisition costs are ~10x lower than legacy carriers, and thereby keep lower premiums.

“Insurers, those relying heavily on exclusive agents, spent an average of $792…to acquire new customers, including agent commissions and advertising expenses… Companies that depend on independent agents spend an average of $900.” (Chicago Tribune)

With lowest cost in the market, what's the customers feedback/ reviews -

Customers rate Lemonade as the No.1 ranked renters insurance company in the US out of 300-plus rated renters insurance companies - Clearsurance Overwhelmingly positive online policyholder feedback, unique and easy-to-use AI chatbot, ultra-low prices, and mission to make a positive social impact - highya Lemonade is the highest ranked insurance app (and one of the highest ranked apps ever - Apple App Store Lemonade customers can use their mobile devices to change coverages, add people to a policy, report a move or cancel a policy.. They also can have their claim approved or denied via the app - US News

So let's how Automation is bringing positive change and highest NPS score among insurance companies

93% of all Insurance companies sell policies offline (via Agents) and we have Lemonade which is 100% digital.

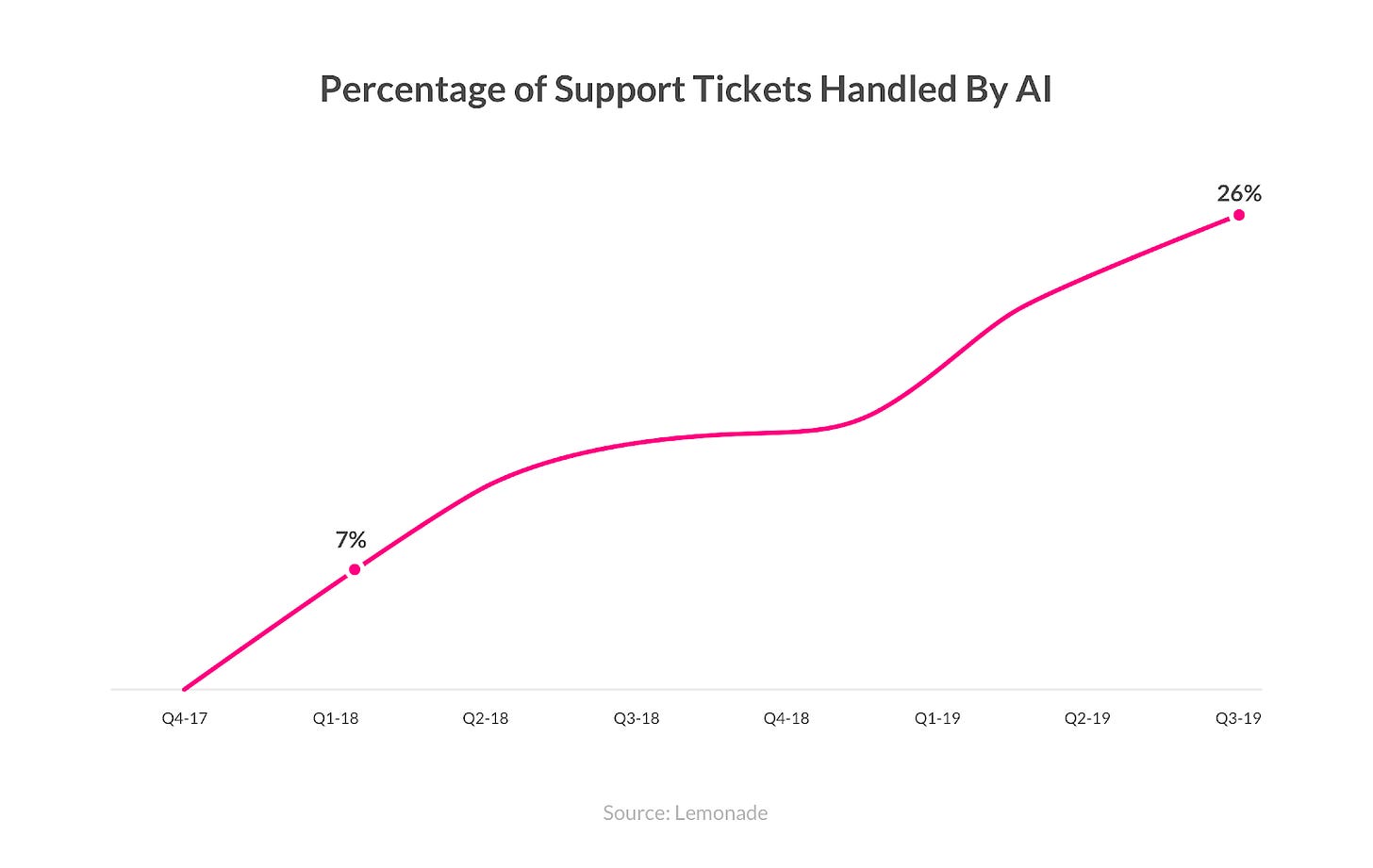

Lemonade has two chatbots - Maya (for onboarding) and Jim (for claim settlement). Both of these run on AI technology to process millions of conversation, onboarding customers, handling claims, providing underwriting, finance, etc. As company claims these are super efficient and delighting customers.

Here’s another data point: Lemonade closely tracks NPS (Net Promoter Score, a universal measure of customer satisfaction), and at over 70 Lemonade is seeing customer satisfaction levels unheard of in insurance, and usually the preserve of venerable companies like Apple.

For comparison, traditional insurance companies are in the low teens of this score, while Apple, known for its incredible customer service scores 72.

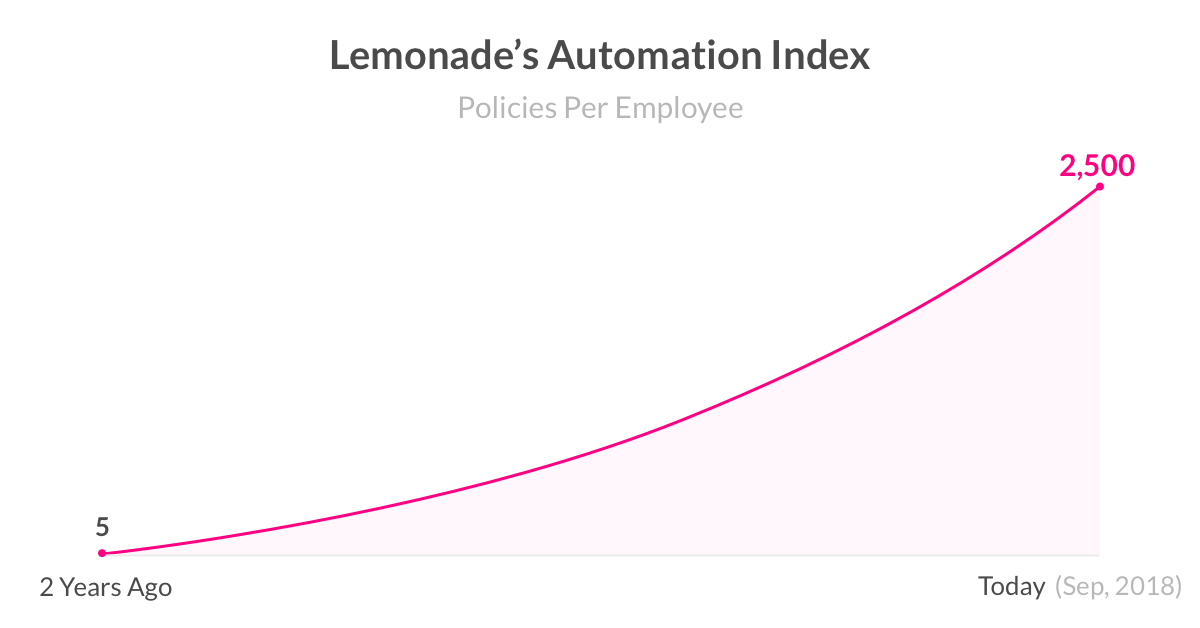

Automation has helped Lemonade to handle high number of Policies and Customers with relatively lower number of employees (and definitely no brokers or agents). And this will only go higher with launch of more products and regional expansion.

Lemonade market opportunity

Products - Currently it offer renters, homeowners, and pet health insurance, however opportunity to expand into other insurance areas like life, health, auto insurance, etc.

Distribution - Currently present in US (licensed in 40 states, however operates only in 28 and expanding), large presence in Israel, and holds license to sell in 31 countries of E.U.

Market opportunity - over USD $5 Trillion spent globally on premiums annually. Not one company owns more than 4% of said market shares

This industry has not digitized yet; no experience with AI. Traditional insurance companies are failing to adapt to digital revolution

Assuming only 4% market share in US or 2% market share globally, we are looking for potential annual revenue of USD $100Bn for Lemonade. From current $100 million revenue to $100 billion revenue, we are looking for 1000x growth in revenue → this is massive opportunity (!!!).

Recap, we now know (1) How it works, (2) Mechanics of ceding cash flow, (3) Digitization impact, and (4) Market Opportunity. Now let's focus on Financials.

Lemonade in-force premium increased to $155M from $72M in 2Q2019. That is a 115% increase YOY (more than 2x growth). However, that is only half the growth of what their Q2 increase from 2018 to 2019 was (208% vs 115%). The YTD in-force premium is $39M over where they ended 2019 (34% increase).

They are seeing a continued increase in premium dollars per customer to $190/customer, mostly driven by the increase in the number of new homeowner policies and the aging of their rental customers who pay more in premium in each successive year of coverage. They have also seen a steady decline in loss ratio to 67% in 2Q20, a number more in-line with the industry . According to the investor call, this is partially driven by the lower loss ratios of homeowners vs renters.

Many times, during the shareholder call, Lemonade mentioned the fact that they generate and use 100x more data than broker-based carriers. This is a structural and growing competitive advantage. By being digital-first, they have created a digital infrastructure that uses AI within a closed-loop system that constantly reinforces itself. Data from one interaction can inform every other interaction. Marketing campaigns become better, fraud detection picks up the faintest signals, etc. While they did not explicitly bring examples here, they can fine-tune processes on the fly, which allows them to more quickly react than a traditional incumbent carrier.

Lemonade has not been profitable since its inception in 2015 and had an accumulated deficit of $198.3 million and $234.8 million as of December 31, 2019, and March 31, 2020, respectively. The company posted net loss of $108.5 million for FY19, and a net loss of $36.5 million for 1QFY20. Lemonade’s quarterly loss has been increasing QoQ.

Lemonade’s growth in revenue and its customers has been good so far. But not clear when the company will become profitable. This will be a major concern for long-term investors.

Why Lemonade is making losses ?

Lemonade loss ratio 70% is the biggest chunk of expenses, followed by increasing Sales and Marketing and G&A expenses, however SG&A as percentage of Revenue is dropping. Absolute value of net loss increased from $52.9M in FY18 to $108.5M in FY19. So the key to profitability is to lower the Loss ratio. With expected - higher revenue and lower loss ratio in future, Lemonade will be on path of profitability sooner or later.

So let's understand what company is doing to improve the Loss ratio

Lemonade is getting smarter. It started at a data disadvantage, building up a data set from scratch and collecting information at every customer interaction. It was only a matter of time before it was at a data advantage.

Lemonade is also getting better at spotting fraud with each passing day. With 100x more data being collected, it is getting exponentially more precise picture of risk.

Also, it is getting faster in terms of Algorithms coding, testing, and rolling out. To put this into better perspective, traditional carriers often push out monthly production releases. While Lemonade now average 8 releases per day. Adjustments to coverage, customer service, claims, language – you name it – delivering world-class customer service while ensuring a sustainable loss ratio, which is declining continuously.

Lemonade's extensive use of AI (tools like Forensic Graph Network and Project Watchtower), helping to drive downward Loss Ratio trend by filtering out bad risks, detecting fraud in real time, and responding to emergencies faster.

Conclusion

It is important for Lemonade to become profitable for the current valuation to be justified. This is a major concern for long-term investors. I think with any future market correction (again buying the time to see net loss slows down and company shows signs of profitability), which will give better margin of safety to enter in this stock. However, long term investor can keep accumulating shares at a regular interval.

There is huge potential for the company to disrupt the whole insurance industry (massive industry) and it is long term play.