Etsy - online marketplace specializing in unique, handmade goods

Investment Thesis -

Etsy is an e-commerce marketplace which connects buyers to sellers of unique, handcrafted, and differentiated goods.

Impressive growth Y/Y and no longer only a niche handcraft e-commerce site

Etsy has shown sustainable competitive advantage in the form of captive customers driven by habit (act as a moat for the company) and its 2020 GMS is small compared to its TAM

Expanding margin, high ROCE, management reinvesting in the business are several of the key factors for investment thesis

Etsy’s value proposition

One of a kind platform offering unique handcrafted goods from creative entrepreneurs around the world - prior to 2020, Etsy was operating in niche market by selling custom T-shirts, custom cup, etc. However pandemic has accelerated true potential of the unique market.

Etsy connects those who love unique, handcrafted and differentiated goods through personalization (made to order), unique/vintage product offerings, different categories of products, inspire people through these offerings.

As of Dec 2020, Etsy got 82M active buyers and 4.4M active sellers (up +64% Y/Y) that generated total gross merchandise sale (GMS) of $10.3bn, up 106% Y/Y.

The number of habitual/repeat buyers on the Etsy marketplace grew by +157% to 6.5mn in 2020 - "customer captivity that is based on habit" is a key sustainable competitive advantage or moat.Significant early stage opportunity to own “Special“ and capture a greater share of large and growing TAM.

As per Mar 2021 Investor Presentation, Etsy highlighted survey from 2019 that WW total retail TAM across 6 core geographies is $1.7T, out of which $100bn is market for “Special“ categories, however that has increased significantly to $250bn allowing Etsy to sustain its strong growth for many years to come.

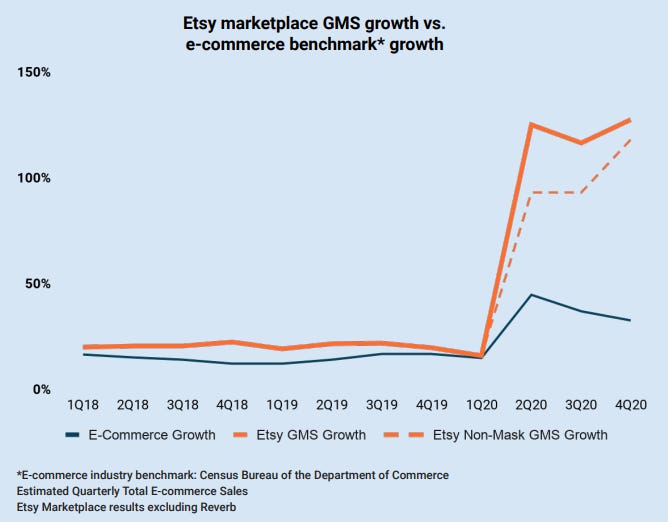

Etsy has outpaced e-commerce growth rate by more than 2.5x in 2020, highlighting Etsy’s strong execution. It is now one of the most recognized e-commerce brands in US (4th largest e-commerce site by monthly visits in US).Successfully executing a long-term growth strategy focused on Right-to-Win - Etsy focus on their core marketplace across 7 core geographies (US, UK, Canada, Germany, Australia, France, India) to build a sustainable competitive advantage across 4 key elements - (1) best-in-class search & discover, (2) human connections, (3) a trusted brand, (4) seller’s collection of unique items. Some of the efforts are evident from the growth as highlighted below -

Etsy also focusing on buyer’s experience by leveraging the power of view for storytelling about the products. The number of videos uploaded has increased from 211K in 2Q20 to 1.3M/3Q20 and 1.7M/4Q20. The impact of product investments are evident in GMS growth -

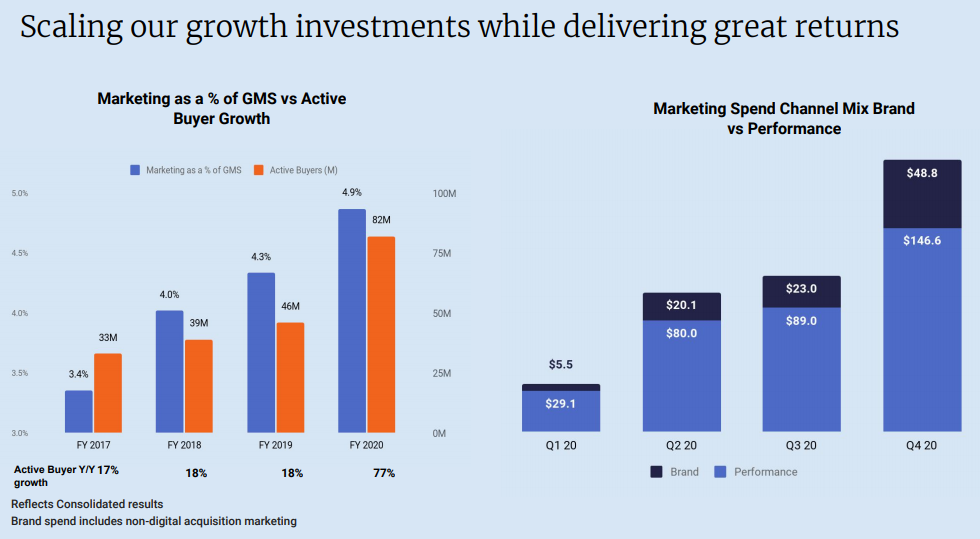

Leveraging strong brand awareness with marketing investments to drive buyer frequency and growth - currently 82M buyers on Etsy platform as of Dec 2020, which is up by +77% Y/Y.

Flexible business model, delivering strong top and bottom line operational and financial performance.

Delivered spectacular 2020 financial results - $10.3bn in GMS (+106% Y/Y), Revenue $1.7bn (+111% Y/Y), Adjusted EBITDA $549M (~32% margin).

Etsy divides revenue in two categories - (1) Marketplace revenue which are listing fee, transaction fee, payment platform, offsite ads transaction fee and (2) Services revenue which are optional value-added services - advertising, shipping labels, others.

Etsy has over 50 different retail categories, top six categories represents over 80% of Etsy GMS, growing 85% Y/Y in 2020.

Agile team, mutually focused on positive business and social impact -

Some of the developments of Etsy management change can be read here, here and here

Financial and Valuation

Strong balance sheet with $1.7bn in cash & equivalents vs $2.4bn in total assets (70% of total assets as cash & equivalents). Long-term debt is relatively low $1.1bn, all of which made up of convertible notes rather than normal stock offerings in order to delay stock dilution.

Etsy has been growing revenue at CAGR 45% over last 7 years, with gross margin ~70% and Net margin improved to 20% in 2020.

Company is also free cash flow positive, generated $0.67bn FCF in 2020, with a CGAR increase of 86% over last 7 years. Cash flow per share increased form 0.47 in 2017 to 5.53 in 2020.

ROCE has increased from 6% in 2017 to 22% in 2020. Similarly, company has increased ROE from 21% in 2017 to 47% in 2020.

Currently, Etsy is trading at around 12.6x NTM EV/Sales and 40x EV/FCF

Comparing to its peers, Etsy has the less capital-intensive business model, highest profitability. Also Etsy is currently trading at $27bn market cap, which is much attractive as compared to overall TAM opportunity for the business.

Based on Technical analysis, price range of $190-$200 seems better entry point for now (pls note this is not a recommendation). Below $190, stock can take support at $150 price level. Dollar-cost-average (DCA) is best way to build position in this stock.

Assuming, conservative growth outlook for Etsy for next 10 years investment horizon with exit P/S ratio of 5, potential to provide CAGR of 12-14% per annum.

Guidance for Q1 2021

For Q1 2021, company expects rapid growth to continue - revenue growth ~130% Y/Y with Adjusted EBITDA margin of 32~34%. For long-term, Etsy has a long runway as its TAM is expanding with international growth for a longer term.

Risks

Etsy’s Push To Compete With Amazon Leaves Sellers Squeezed By Rising Costs - In an effort to drive new customers to the site, Etsy said on Wednesday that it will now require many of its sellers to pay for advertisements on Instagram, Facebook, Pinterest and other platforms. It has also been pushing sellers to offer free shipping in recent months. These initiatives are putting pressure on small businesses to raise prices, absorb the cost or both.

Threat from Amazon to enter niche/handcrafted products with a new website.