Summary

Coupang is in my watchlist as it is close to investable range. There are couple of areas which needs to be closely monitored - (1) Financials improvement, and (2) Market share gain vs competition (specially Naver).

Also, Coupang should look for profitable business segment (like Garena of Sea Limited or AWS of Amazon) to bring high profitable business segment to its belt. This will help to generate additional cash for the business so that Coupang has enough cash cushion to expand in other regions/countries against more cash rich competitors.

Coupang is mix of Amazon, Instacart, and DoorDash with a pinch of PayPal. Best-known as a customer-obsessed e-commerce platform, Coupang is quickly outgrowing those roots, even as it improves its core business efficiencies. The company has compounded revenue at 60% a year from 2016 to 2020, reaching $12 billion, though it remains unprofitable. Coupang business model includes following items - (1) E-commerce sales of third-party & first party goods, (2) Coupang Eats, (3) Rocket WOW membership, (4) Fulfillment & logistics by Coupang, (5) SaaS offerings for merchants, including advertising and myStore.

A. Business quality checklist

1. Financials: 6 out of 17

Balance sheet - strong balance sheet with $4.3bn in cash & short-term equivalents, driven by IPO in Mar 2021, where company raised $3.4bn through issuance of common stock.

Gross margin - low gross margin business, driven by fulfillment model where customers can join Rocket WOW membership program for a flat monthly fee to receive unlimited free shipping for millions of products with no minimum spend (also includes Dawn delivery and same-day delivery shipping options). This level of fulfillment does create moat (switching cost & low-cost advantage), however increases COS (cost of sales), which results in low gross margin. +1 point for rising gross margin outlook. Coupang has vertically integrated most of its logistics; that's allowed the company to offer best-in-class delivery and created a brand known for its thoughtfulness. Also, Coupang fulfillment drivers are employees of the company (and not contractors) - its 15,000 drivers are the largest directly employed fleet in Korea. At the same time, in January 2021, it registered Coupang Logistics Services, a subsidiary that aims to achieve total logistics domination in the country, this will definitely help to improve gross margin of the business through the help of operating leverage. Further economies of scale and direct sourcing could improve gross profit. Additionally, Coupang is investing in under-penetrated but high gross profit categories like apparel, beauty, and consumer electronics. Increasing the mix of private-label goods is another opportunity.

ROE, ROA, ROIC - currently negative net income so ROIC is negative.

Free cash flow - currently negative free cash flow. FY20 was ($183)M FCF and LTM is ($759)M FCF. Capex is ~$500M annually. In its S-1 document, management says that its long-term focus would be on increasing free cash flow while minimizing shareholder dilution.

EPS - negative EPS though net income margin is improving over the years

2. Moat: 20 out of 20

Wide moat or no moat

network effect (none/ weak/ strong) - Coupang has network effect with its Rocket delivery, Rocket Fresh, Coupang Eats, Rocket WOW membership program to keep customers loyal and connected to remain in the platform.

switching costs (none/ weak/ strong) - definitely got switching cost advantage for customers move away from Coupang platform

durable cost advantage (scale/ distribution/ physical location/ vertical integration) - Coupang provides unlimited free shipping for millions of products with no minimum spend, which provide cost advantage to the customers.

Widening moat or narrowing moat - Coupang is able to widen its moat (specially network effect) by offering multiple services to customers (business has optionality to expand its offerings).

Competitive landscape -

Coupang competes with players across legacy retail, general e-commerce, niche players, etc. While legacy retail players (Hyundai, Shinsegae, Lotte) are not a big threat as not well positioned to make a digital leap.

In Korea, Coupang competes with e-commerce players like GMarket & Auction (owned by eBay), 11st, WeMakePrice, and TMON. eBay puts South Korean unit up for sale in $4bn deal, however not found buyer suggests that Coupang has also passed on the opportunity. TMON has been forced to shutter several business lines, while 11st shelved its plans to IPO after weak financial results. Other threats come from Amazon & Sea Limited. Like Amazon, Sea Group has the benefit of a money-spinning operation to finance new, lower-margin endeavors. For now, both Amazon & Sea Limited have not shown strong focus on Korea market.

Niche players - Coupang competes with Emart, Homeplus, Wemakeprice, Market Kurly, and others in the grocery delivery space, with Coupang has highest market share of 21.9% in 2019/beginning and second place Emart with 14.8% market share. Coupang should have gained market share in last 2 years. In food delivery, Coupang's market share is considerably lower as compared to market leader Delivery Hero. In payments, market is dominated by Kakao pay with 34mn users, followed by Samsung (19mn users), 11Pay, Toss, Naver, and LG Pay.

Naver - most realistic competition comes from search giant of South Korea. In e-commerce (b2c) space Nave has ~8% market share vs Coupang ~25%. However, c2c market is dominated by Naver. Korea has yet to have a player that rules both C2C and B2C channels, such as Alibaba in China or Amazon in the US. Naver is Korea's largest search portal and has multiple verticals taking on Fintech, E-Commerce, Cloud Computing, Media, and Content. Naver is deeply profitable and can toss cash to enter into a deliberate pricing war with Coupang (Naver partnered with eMart (think Walmart of Korea) as well as CJ Logistics (one of the largest logistics providers) to seemingly double down on their e-commerce efforts). In addition to Search & E-commerce, Naver has got Naver Plus (similar to Amazon Prime w/o video), Naver Pay, and Naver SmartStore (third-party marketplace). Naver has recently started a project titled "Jangbogi", which is a push into grocery delivery. Naver is playing in all the business segments of Coupang: E-commerce through Naver Open Marketplace, Fresh through Jongbogi, Eats through investor in Baedal Minjok, Pay through Naver Pay. Market share of each of these 4 segments should be closely watched over next couple of years to measure the share gain of Coupang & Naver.

3. Future Potential: 17 out of 17

Optionality - Coupang started as a daily deal play, however changed business model to e-commerce and added food-delivery and grocery delivery. Company is also investing in under-penetrated but high gross profit categories like apparel, beauty, and consumer electronics. This shows high level of optionality. Coupang has fintech solution too - Coupang Pay in its current form is just a payment API that allows smaller websites to accept payment using Coupang's backend.

Coupang appears to be looking to expand out of South Korea for the first time as the company's LinkedIn page shows recent job postings for senior executive roles in Singapore.Organic growth - company is growing revenue at 60% a year from 2016 to 2020

'top dog & first mover' (industry disruptor)

Operating leverage - Coupang has invested heavily in e-commerce infrastructure and uniquely positioned to improve operating efficiencies and grow into Korea's large e-commerce TAM. Coupang outlaid $700M in capital expenditures (capex) across 2019 and 2020 on building out its network. The company also made investments in designing its own trucks to make delivery hyper-efficient.

4. Customers: 8 out of 10

Marketing costs - Coupang has high marketing cost. At one point, it was the largest Facebook advertiser in Korea; on average users in the region saw 72 Coupang ads a month. However good part is SG&A as percentage of revenue is coming down from 33% in 2018 to 29% in 2019 & 23% in 2020.

Cyclical demand or recession proof demand - E-commerce is secular demand. As reported by Financial Times - South Korea's e-commerce market has grown 22% to $71.7bn in 2018, accounting for 24% of retailing, the highest in the world, followed by 23.7% in China, 8.6% in Japan and 13.7% in US, according to Euromonitor International. South Korea is the world's fifth largest ecommerce market and is forecast to become the 3rd largest after China and US within five years.

5. Revenue: 8 out of 10

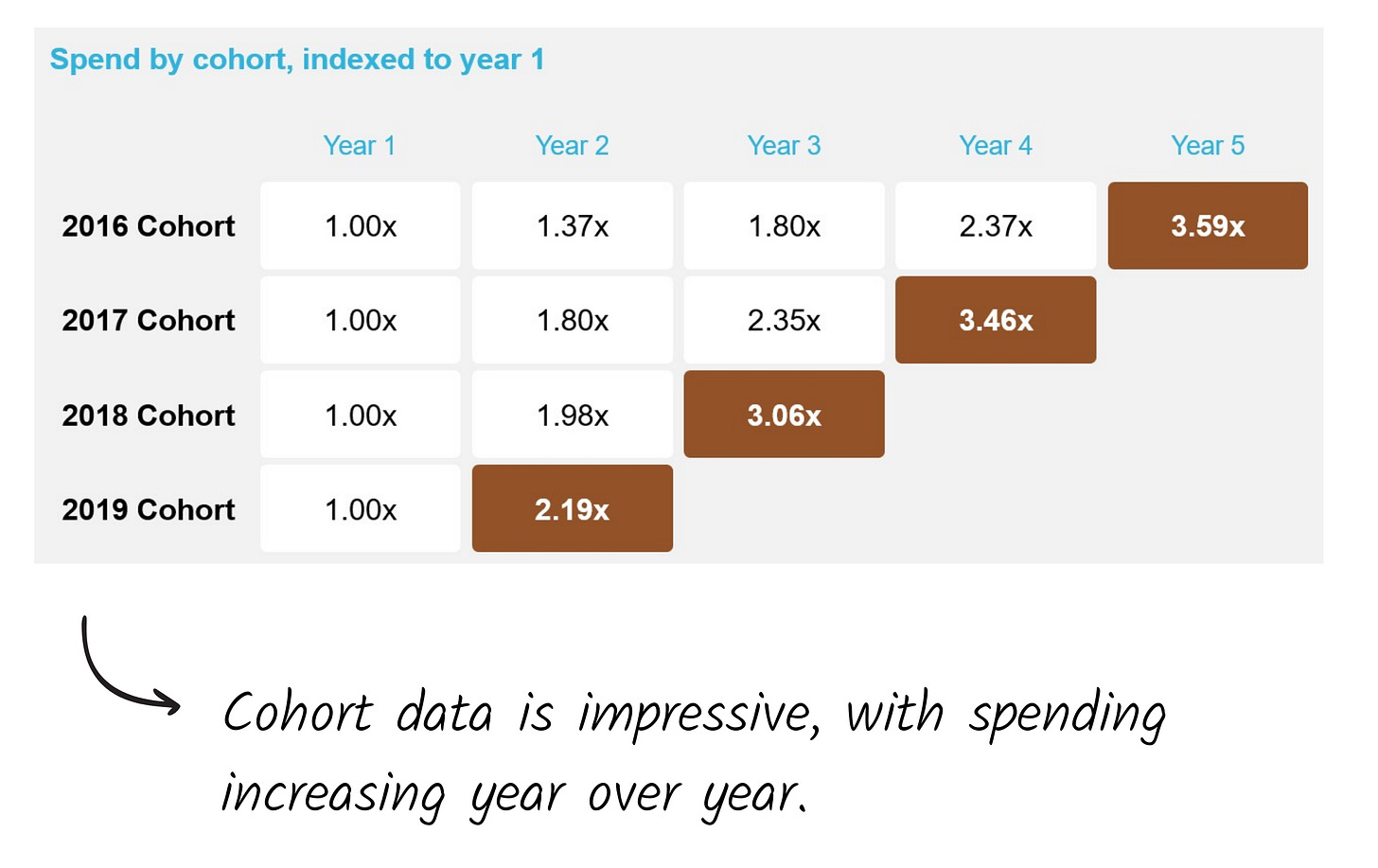

Recurring revenue or one-off sales - business model is recurring revenue. Coupang has strong spend growth and retention. Coupang measures customer retention through customer cohort - indexed growth in spend by customer cohort, irrespective of cancellations and returns, with each cohort representing customers who placed their first order with company in a given year. Cohorts consistently increase their spend, e.g., 2017 cohort increased its annual spend by approximately 3.46x in 2020 compared to 2017. Similarly, 2018 cohort increased annual spend by 3.06x in 2020 compared to 2018.

Business got pricing power - company has pricing power, however seeing huge competition in each of the business segments it plays (whether e-commerce, fresh, eats, pay, etc.), limits its pricing power.

6. Management/Culture: 12 out of 14

Founder or a new hired gun CEO - Coupang is founder-led company. Bom Kim is founder & CEO - after dropping out of HBS to start Coupang, Kim turned to Ben Sun, a Partner at Primary Venture Partners, to help him imbue his company with the Silicon Valley way of drafting and managing top-tier employees. Over the years, Kim has succeeded in poaching talent from organizations like Naver, Uber, Amazon, and even the Korean government. Bom Kim is customer-obsessed person, which may not always translate into the most copacetic managerial environment, which has resulted in high turnover at management level.

Insider ownership - high insider ownership with CEO Bom Kim owns 76.2% of voting rights.

Good/bad place to work - company received 3.9 out of 5 stars in Glassdoor, with 74% recommending the company to a friend and 82% approving of the CEO. As a comparison, 95% of Naver employees would recommend the company to a friend.

Mission statement - Coupang is mission driven company "To create a world where customers wonder: “How did I ever live without Coupang?"" CEO Bom Kim is customer-obsessed and driven to build future of commerce.

7. Stock: 0 out of 11

Stock that has crushed the market or lost badly (based on philosophy that winners keep winning) - Coupang listed in Mar 2021, so we do not have long history of stock performance, but currently underperforming to S&P by huge. Coupang is Korea’s first real blockbuster startup, 2021’s largest US IPO so far, and is now valued publicly at ~$65bn, having peaked at ~US$100bn on its first day of trading. Company was valued at $9bn in 2019, so it is currently 7x from 2019 valuation. Currently company is available at 4.7x P/S multiples. Coupang's analog competitors (Lotte, Shinsagae) in Korea are $2-3B market cap companies. Coupang has potential to become a platform company or super app, then it may receive valuation similar to Alibaba (4.5x NTM revenue) or Amazon (3.3x NTM revenue), however Coupang has only ~18% gross margin vs Alibaba/Amazon at ~40% gross margin. Certainly, Coupang has to add more profitable business segments (like Garena of SEA Limited, AWS of Amazon, etc.) to earn higher gross margin (at >40% level) and receive sustainable higher revenue multiple.

Buybacks, dividends, and debt repayments - no buybacks, dividends

Company that beats estimates or misses them - company has missed Q1 2021 earnings estimate huge percentage (estimate -0.16 vs actual -0.42)

Total score for business quality comes out to be 72 out of 100.

B. Detractors checklist -

Accounting irregularities = none

Customer concentration = none

Industry disruption (actively being disrupted, possible disruption, no foreseeable disruption risk) = none

Outside forces determine success, e.g., banks & interest rates, oil companies & oil prices, gold producers & gold price, cyclical & strong economy = none

Big market loser "winner keep on winning; losers keep on losing" = none

Binary event ahead = none

Extreme dilution from stock-based compensation = -2 (stock-based compensation is high & increasing).

Growth by acquisition = none

Complicated financials = none

Anti-trust concerns = none

Headquarter risk = -1 (country risk, next to North Korea)

Currency risk = none

Final score

A + B = 71 - 3 = 68; resulting score (80+ why don't I own it, 70-79 investable, 60-69 close/watchlist/occasionally buy, <60 why bother)

Please note that this article does not constitute investment advice in any form. This article is not a research report and is not intended to serve as the basis for any investment decision. All investments involve risk and the past performance of a security or financial product does not guarantee future returns. Investors have to conduct their own research before conducting any transaction. There is always the risk of losing parts or all of your money when you invest in securities or other financial products.

Hi Market Musing, this was an excellent post. Could you do a write up on your investment criteria on how each section of the points are allocated? This would be very helpful. Cheers and have a good day (: