The best thing a human being can do is to help another human being know more. — Charlie Munger

The true value investor, who deserves my utmost respect, is somebody who devotes their life to their passion for reading. Nobody can spend their life studying for 50 years —which is what we do—if they don't enjoy it.

The best investment you can make is an investment in yourself

I constantly see people rise in life who are not the smartest, sometimes not even the most diligent, but they are learning machines. They go to bed every night a little wiser than they were when they got up and boy does that help, particularly when you have a long run ahead of you. — Charlie Munger

Lifelong learning is paramount to long-term success. Without it, we won't succeed, because we won't get far based on what we already know.

Simple formula - but not easy - to acquire wisdom is - Read. A lot. It involves a lot of hard work, patience, discipline, and focus. Warren Buffet, one of the most successful people in the business world, describes his typical day: "I just sit in my office and read all day." Sitting. Reading. Thinking.

One, when asked about they key to his success, Buffett held up stacks of paper and said, "Read 500 pages like this every day. That's knowledge works. It builds up, like compound interest. All of you can do it, but I guarantee not many of you will do it."

Self-improvement is the ultimate form of investing in oneself. It requires devoting time, money, attention, and hard effort now for a payoff later, sometimes in the far distant future. A lot of people are unwilling to make this trade-off because they crave instant gratification and desire instant results.

The game of life is the game of everlasting learning. Formal education will make you a living; self-education will make you a fortune. Develop into a lifelong self-learner through voracious reading; cultivate curiosity and strive to become a little wiser every day.

What many people see as a three-hundred page book is often the accumulation of thousands of hours and decade of work. Where else can you get the entire life's work of someone in the space of few hours. The best way to learn something is to try to do it, but the next best way to learn is from someone who has already done it. This is the importance of reading and vicarious learning.

Becoming a learning machine

Why we should inculcate a healthy reading habit - Reading keeps our mind alive & growing. It is also meditative and calming. The way to achieve success in life is to learn constantly. And the best way to learn is to ready.

"In my whole life, I have known no wise people who didn't read all the time—none, zero. You'd be amazed at how much Warren reads—at how much I read. My children laugh at me. They think I'm a book with a couple of legs sticking out." — Charlie Munger

The more you read, the more you build your mental repertoire. Incrementally, the knowledge you add to your stockpile will grow over time as it combines with everything new you put in there. This is compounding in action, and it works with knowledge in much the same way as it does with interest. Eventually, when faced with new, challenging, or ambiguous situations, you will be able to draw on this dynamic inner repository, or what Munger refers to as a "latticework of mental models."

*Curiosity is antifragile, like an addiction; magnified by attempts to satisfy it You've got to keep control of your time, and you can't unless you say no. You can't let people set your agenda in life—*Warren Buffet

How to read a book - here's how Alder and Van Doren describe these 4 levels -

Elementary reading - most basic level of reading as taught in our elementary schools.

Inspectional reading - another name for "scanning" or "superficial reading." It means giving a piece of writing a quick yet meaningful advance review to evaluate the merits of a deeper reading experience.

Analytical reading - thorough reading. This is the stage at which you make the book your own by conversing with the author and asking many organized questions.

Syntopical reading - allows you to synthesize knowledge from a comparative reading of several books about the same subject. Also known as comparative reading, involves reading many books on the same subject and then comparing and contrasting the ideas, insights, and arguments within them.

The Matthew Effect in Knowledge Acquisition - refers to a person who has more expertise and thus has a larger knowledge base. This larger knowledge base allows that person to acquire greater expertise at a faster rate. So, the amount of useful insight that Buffett can draw from the same reading material would be quite high compared with most any other person, and again, Buffett would end up becoming smarter at a faster — Snowball effect.

Obtaining worldly wisdom through a Latticework of Mental models

In the story of the blind men and the elephant, you cannot see the whole picture. And investing a liberal art that involves cross-pollination of ideas from multiple disciplines.

Charlie Munger uses a latticework of mental models to make more rational and effective decisions. As the Chinese proverb goes, "I forget what I hear; I remember what I see; I know what I do." Because the best way to learn something is by practicing it, we must routinely apply the mental models to different situations in our daily lives. Munger believes that by using a range of different models from many different disciplines - psychology, history, mathematics, physics, philosophy, biology, and so on - a person can use the combined output of the synthesis to produce something that has more value than the sum of its parts.

In Munger's view, it is better to be worldly wise than to spend lots of time working with a single model that is precisely wrong. A multiple-model approach that is only approximately right will produce a far better outcome in anything that involves people or a social system.

Lollapalooza effects - when two, three or four forces are all operating in the same direction. And, frequently, you don't get simple addition. It's often like critical mass in physics where you get a nuclear explosion if you get to a certain point of mass—and you don't get anything much worth seeing if you don't reach the mass.

The more models you have from outside your discipline, and the more you iterate through them in a checklist sort of fashion when faced with a challenge, the better you'll be able to solve the problems.

The 5 Elements of Effective Thinking by Dr. Edward B. Burger and Dr. Michael Starbird -

Understand deeply - when you learn anything, go for depth and make it rock solid. Identify the core ideas and learn them deeply.

Make mistakes - Mistakes highlight unforeseen opportunities as well as gaps in our understanding. And mistakes are great teachers.

Raise questions

Follow the flow of ideas - To truly understand a concept, discover how it evolved from simpler concepts. You need to use the existing idea and improve it.

Change - Be amenable to change. Each of us remains a work in progress—always evolving, ever changing. We're all rough drafts of the person we're still becoming.

Harnessing the power of passion and focus through deliberate practice

Take up one idea. Make that one idea your life—think of it, dream of it, live on that idea. Let the brain, muscles, nerves, every part of your body, be full of that idea, and just leave every idea alone. This is the way to success. — Swami Vivekananda

Ikigai - reason to live. The only way to deep happiness is to do something you love to the best of your ability. And once we have discovered our calling in life, we need to embrace the power of focus.

I fear not the man who has practiced 10,000 kicks once, but I fear the man who has practiced one kick 10,000 times. — Bruce Lee

Give me six hours to chop down a tree and I will spend the first four sharpening the axe. — Abraham Lincoln

Many of the highly successful people in the world attribute their success to a singular focus - a deep commitment to the pursuit of one main goal. Focus directs your energy toward your goals.

You have to learn the rules of the game. And then you have to play better than anyone else. — Albert Einstein

The only way to gain an edge is through long and hard work. Do what you love to do, so you just naturally do it or think about it all the time, even if you are relaxing.. Over time, you can accumulate a huge advantage if it comes naturally to you like this. — Li Lu

Pursue your passion. You won't get this time back ever again.

Deliberate Practice - greatness can be developed by any individual, in any field, through the process of what he calls "deliberate practice." It requires continuous evaluation, feedback, and a lot of mental effort.

It's repeatable - keep practicing

It receives constant feedback - learning occurs when you get lots of feedback tied closely in time to decisions and actions

It is hard - takes significant mental effort

It isn't much fun - most people don't enjoy doing activities that they're not good at. Yet deliberate practice is designed to focus specifically on those things you are weak at, practice until you master them.

Finding our calling in life, pursuing it with a strong passion and intense focus, and engaging in deliberate practice results in ikigai.

We are what we repeatedly do. Excellence, then, is not an act, but a habit.

Building Strong Character

Warren Buffet — I was lucky to have the right heroes. Tell me who your heroes are and I'll tell you how you'll turn out to be. The qualities of the one you admire are the traits that you, with a little practice, can make your own, and that, if practiced, will become habit forming.

Role models act as our motivational coach and as a source of daily inspiration in our lives. You may wonder how one learns from his or her role model - you need to read about the lives of these people, what they have accomplished over the years, and how they learned, and then learn from their experiences.

Nothing, nothing at all, matters as much as bringing the right people into your life. They will teach you everything you need to know. — Guy Spier

It is better to be an average guy on a star team than a star guy on an average team. The former will be better for you in the long term; the latter is just an ego trip. It is wiser to be with better people and to be uncomfortable than to limit your self to a mediocre circle just to feel comfortable.

Humility is the gateway to attaining wisdom — acknowledging what you don't know is the dawning of wisdom.

Ego = 1 / Knowledge — more the knowledge lesser the ego, lesser the knowledge more the ego.

Becoming rich vs staying rich - many people achieve success, but to sustain the same (and potentially build on it) over an entire lifetime requires humility, gratitude, and a constant learning mind-set.

There are million ways to get rich. But there's only one way to stay rich: Humility, often to the point of paranoia. The irony is that few things squash humility like getting rich in the first place.

The circle of competence - Warren Buffet has always advised investors to focus on operating only in areas they understand the best. The lesson for investors, Buffett says, is that we don't have to swing at every pitch: "The trick in investing is just to sit there and watch pitch after pitch go by and wait for the one right in your sweet spot. And if people are yelling, 'Swing, you bum!' ignore them." The size of that circle is not very important; knowing its boundaries, however, is vital.

In investing, risk comes from not knowing what you are doing. Try to know the things you don't know, and then draw a circle that keeps those things out.

The basic idea behind the circle of competence is so simple it is embarrassing to say it out loud: when you are unsure and doubtful about what you want to do, do not do it. If you can't find businesses within your circle of competence, don't hurriedly step outside that circle because of the fear of missing out, which is often the case in a bull market. Instead spend time studying industries and companies outside your circle before crossing the boundaries. There's a simple way (not easy) to expand the circle of competence - Read. A lot.

Achieving financial independence - the goal of financial independence is to stop depending on others (bosses, clients, a schedule, a paycheck). True wealth in measured in terms of personal liberty and freedom, not monetary currency. Building wealth over time has less to do with your income levels or investment returns and more to do with your savings discipline. You can build wealth without a high income but have no chance without any savings. One of the most effective way to increase your savings is to raise not your income but your humility.

If money were the true measure of wealth, every rich person would be happy. But we know this is not true. Money can't buy a loving family, good health, integrity, ethics, humility, kindness respect, character, or a clear conscience. The most important things in life are priceless, and those are true measures of wealth. Lasting happiness is achieved by living a meaningful life - a life filled with passion and freedom in which we grow as individuals and contribute beyond ourselves.

Using Munger's life as a blueprint, we can observe a pathway toward achieving financial independence -

Work hard, get an education, develop a valuable skill

Use that work career and save up then times your living expenses

To accelerate wealth accumulation, you can take some risk and start some sort of business

At some point, your investments will earn enough passive income to support your living expenses

Spend each day trying to be a little wiser than you were when you woke up. Discharge your duties faithfully and well. Step by step you get ahead, but not necessarily in fast spurts. But you build discipline by preparing for fast spurts.. slug it out one inch at a time, day by day. At the end of the day—if you live long enough—most people get what they deserve. — Charlie Munger

The path to lasting wealth is deferred gratification, savings, and compound interest. Develop the habit of saving in such a way that you enjoy your present reasonably well and also ensure a bright future tomorrow. Save enough so that you are able to live a better lifestyle in the future than you are living today. Reducing your desires has the same effect as increasing your wealth, but with no downside risk. being content in life and having fewer needs enables you to be happy in any situation. — And that is real wealth and freedom.

Usually, if we try to tackle a big life change all at once—like completely cutting out sugar or learning to invest in the stock market or inculcating a reading habit—it might work for a while, but we will give up soon. However, taking small, incremental steps is the way to get past that and succeed. For example, when it comes to investing in the stock market, if you want to form the habit of reading one annual report a day, start with reading one page of an annual report a day, then increase it to two pages, then three, and so on.

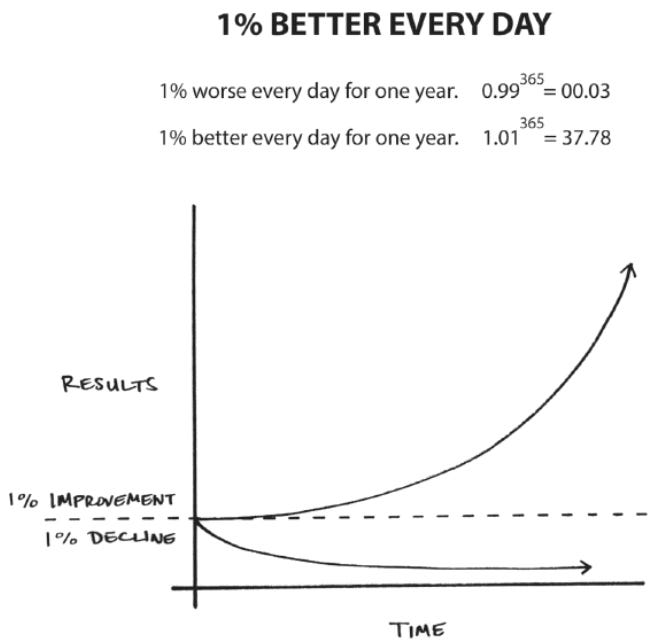

If you can get just 1 percent better each day, you'll end up with results that are nearly 37 times better after one year.

Common Stock Investing

The stock market is the best place to look at buying businesses at substantial discounts or selling them at staggering premiums. The biggest advantage for an individual investor is the option to calmly wait until identifying a business that is available at a significant discount to intrinsic value.

Be passionate about the business but dispassionate about the stock. A true feeling of owning a business gives an investor the conviction to hold; you want to savor the journey alongside the promoters. Invest for the long term. Live fully today.

Capital Stewardship - As an investor, your goal is to find businesses which are run by leaders who steward capital and are accountable for their words and actions. Capital Stewardship reveals whether a CEO's actions are based on attitudes of being entrusted with or entitled to investor capital.

Capital discipline - CEOs who are good capital allocators typically offer commentary about returns on investment, on invested capital, and on assets. Is capital allocation discussed explicitly and rationally? Are words consistent with actions? Are actions and words consistent over time?

Cash flow - Look for CEOs who place a great deal of emphasis on cash flows and communicate about it in a clear manner.

Operating and financial goals - meaningful financial goal statements indicate that a CEO is serious about efficient capital allocation. Look for CEOs who have low salaries and high stock ownership, as they get rich only when shareholders get rich.

Investors who read between the lines and look for the absence of candor can spot companies like this that may be headed for trouble. To evaluate the quality of the management, you don't need privileged access to insider information. The secret is right in front of you - in the words of every shareholder letter, annual report, and other corporate correspondence,

Checklist routines avoid a lot of errors. You should have all this elementary [worldly] wisdom and then you should go through a mental checklist in order to use it. There is no other procedure in the world that will work as well. — Charlie Munger

Ask the right questions; you'll get valuable answers. Do the initial groundwork. A prudent investor never purchases ownership in a company without conducting the necessary due diligence. Learn about the company and its competitors (both listed and unlisted) from company websites, filings, and information on the internet. Read the past ten years' worth of annual reports, proxies, notes and schedules to the financial statements, and management discussion and analysis (check for changes in tone and industry outlook) and observe the recent trends in insider shareholding.

Skin in the Game

Capital allocation is a CEO's most important job. How he or she allocates the capital what determines the value created for the business and its shareholders in the long run. Many CEOs fail in allocating capital because of their incentive structure, which is aligned to what they can do in the short term rather than what they should do for the long term. This is why Munger says, "Perhaps the most important rule in management is to get the incentives right." The presence of misaligned incentives results in perverse outcomes.

You probably would not choose to dine at a restaurant whose whose chef always ate somewhere. You should be no more satisfied with a money manager who does not eat his or her own cooking.

Early in the history of Xerox, Joe Wilson, who was then in the government, had to go back to Xerox because he couldn't understand how their better, new machine was selling so poorly in relation to their older and inferior machine. Of course when he got there, he found out that the commission arrangement with the salesmen gave a tremendous incentive to the inferior machine. — Charlie Munger

Investing in stocks is an art, not a science, and people who've been trained to rigidly quantify everything have a big disadvantage. — Peter Lynch

As investors, we do not need to endlessly strive for precision. Just being approximately right while having a good margin of safety is sufficient to get the job done. Remember, you don't need a weighing sale to know that a four-hundred-pound man is fat. Don't obsess over whether the business will earn $2 or $2.05 in the next quarter. Focus instead on finding a big gap between current price and the value you have placed on long-term earning power using conservative estimates to create a large margin of safety, just in case your initial assessment is wrong. But you don't in a situation in which a complicated financial model is required to justify a purchase. Keep things simple.

Value investors commonly joke that more fiction has been created using Excel than Word. Because of deeply ingrained confirmation bias, we do not need a spreadsheet to provide us with "goal seek" function. This function is embedded in our brains. Extensive spreadsheets and complex quantitative software tools can be harmful to one's financial well-being. Time changes in input assumptions can dramatically change the estimate of intrinsic value. A DCF model remains the best strategic destination for all analysts where their imagination of PE, P/B, P/S ratios or EV multiples failed to reach.

Buffett says, "Price is what you pay. Value is what you get." So we have to ensure that we do not pay more than the intrinsic value of a company. Now this poses a challenge - we have to compare the price, which can be measured precisely, with an inherently imprecise estimate of value.

Investing is less a field of finance and more a field of human behavior. They key to investing success is not how much you know but you behave. Your behavior will matter far more than your fees, you asset allocation, or your analytical abilities. Emotional intelligence has a much bigger impact on the success or failure of investors than the college they attend or the complexity of their investment strategy.

Intrinsic value - The process of determining the intrinsic value of a business is an art form. You cannot follow rigid rules to plug data into a spreadsheet and hope that it spits out the value for you. It is a moving target that is constantly changing as fundamental data come out and investors update their "expectations" based on knowledge and past experience. Intrinsic value of an asset is the sum of the cash flows expected to be received from that asset, over its remaining useful life, discounted for the time value of money and the uncertainty of receiving those cash flows.

In Security Analysis, Graham, contrary to popular belief, actually spends a lot time discussing future earnings— not what the business earned in the past but rather what we can expect the business to earn each year on average in the future. Graham was signaling that valuation is an art form. Determining the present value of all the future cash flows of a business involves looking at the various aspects of a business's DNA, including its capital intensity, business model durability, balance sheet strength, profitability, competitive position, future growth prospects, and management bandwidth, among other factors—all weighted and compared with the current price.

The intrinsic value is the sum of the present value of the cash flows during the explicit forecasting period and the present value of the terminal value. Less predictable cash flows need to be discounted at a higher rate.

The best outcome that an investor can hope to achieve when it comes to appraising business values is to come up with a range of values and then wait for the market to offer a price that is significantly below the lower end of the range—this gives you both a margin of safety on your investment in the event your analysis is wrong and high returns on your investment if you are right.

The essential point is that security analysis doesn't seek to determine exactly what is the intrinsic value of a given security. It needs only to establish that the value is adequate - e.g., to protect a bond or to justify a stock purchase—or else that the value is considerably higher or considerably lower than the market price. For such purposes an indefinite and approximate measure of the intrinsic value may be sufficient. — Security Analysis

In 1934 edition of Security Analysis, Graham discusses the flexibility of the concept of intrinsic value as "a very hypothetical 'range of approximate value', which would grow wider as the uncertainty of the picture increased." To deal with an inherently uncertain future, an investor needs to consider various possible scenarios when forecasting a company's future cash flows and calculating its intrinsic value. One could produce a range of potential intrinsic values by performing a sensitivity analysis in which the assumption about one or more of the future cash flow components varies over time.

Value Traps - The traditional "value investor" mentality of buying cheap securities, waiting for them to bounce back to "intrinsic value," selling and moving onto the next opportunity, is flawed. In today's world of instant information and fast-paced innovation, cheap securities increasingly appear to be value traps; often they are companies ailing from technological disruption and long-term decline. This rapid recycling of capital also created an enormous drag on our after-tax returns. In addition, by focusing on these opportunities, we incur enormous opportunity costs by not focusing instead on the tremendous opportunity costs by not focusing instead on the tremendous opportunities created by the exceptional innovation S-curves we are currently witnessing.

Everything trades at the level it does for a reason. High quality tends to trade at expensive valuation and junk or poor quality is frequently available at cheap valuation. In the stock market, prices usually move first, and the reported fundamental follow.

Rule number 1: Never lose money. Rule number 2: Never forget rule number 1. — Warren Buffett

When you pay low entry prices, you don't need many good things to happen for you to get a good return. Even if some bad news comes out about the company, because it already has been discounted, the stock price impact is limited. Conversely, if any good news emerges, you get a highly positive result.

Quality increases the Margin of Safety over time

If you plan to hold a share for the long term, the rate of return on capital it generates and can reinvest at is far more important than the rating you buy or sell at. — Terry Smith

A business that can grow intrinsic value at a rate of 18 percent annually is worth much more than a business that is growing its value at 6 percent annually, all other things being equal.

The problem with investing only in statistically cheap securities (also knows as "cigar butts") is that the underlying business's economic value gradually erodes with each passing day, making the investment a race against time. As investors, our goal should be to minimize the number of decisions and to reduce the potential for unforced errors.

The stock markets, in aggregate, have been a positive-sum game over the long term. One way to reduce unforced errors in investing is to carefully choose the businesses that we decide to own. Investors are better off with a few solid long-term choices than flitting from one speculation to another, always chasing the latest hot stock in the market. When investing in short-term opportunities like commodities, cyclicals, and special situations, pay greater attention to price and mean reversion, but when investing in long-term compounders, pay maximum attention to the quality of business and management above all else.

It's far better to buy wonderful company at a fair price that a fair company at a wonderful price. We look for first-class businesses accompanied by first-class managements. — Charlie Munger

Portfolio Management

Leaving the question of price aside, the best business to own is one that over an extended period can employ large amounts of incremental capital at very high rates of return. The worst business to own is one that must, or will, do the opposite—that is, consistently employ every-greater amounts of capital at very low rates of return. — Warren Buffett

According to Charlie Munger, over the long term, it's hard for a stock to earn a much better return than the business which underlies it earns. If the business earns 6 percent on capital over 40 years and you hold it for that 40 years, you're not going to make much different than a 6 percent return even if you originally buy it at a huge discount. Conversely, if a business earns 18 percent on capital over 20 or 30 years, even if you pay an expensive looking price, you'll end up with a fine result.

It's simple but not easy. One of the biggest challenges in investing is determining the competitive advantage (defined as ROIC over cost of capital) of a business and, more important, the durability and longevity of that advantage. Great businesses are those with an ever-increasing stream of earnings with virtually no major capital requirements. They are characterized by negative working capital, low fixed asset intensity, and real pricing power.

Longevity of growth -

The market places a heavy weight on certainty. Stocks with the promise of years of predictable earnings growth tend to go into a long period of overvaluation, until such time that they are no longer able to grow earnings in a steady manner. Predictability of long-term growth matters more to the market than the absolute rate of near-term growth, so a stock that promises to grow earnings at 50 percent for the next couple of years, with no clarity thereafter, is given a lower valuation multiple by the market than a stock that has slower but highly predictable growth for a much longer period.

The longevity of growth is always given a greater weigh by the market than the absolute rate of growth. The actual threat to a bull market stock is not excessive valuation but a sharp correction in its growth expectations by the investor community, because valuations remain expensive and then become excessive until such time as the company delivers above-average rates of growth.

Good businesses are those that require a significant reinvestment of earnings to grow and produce reasonable returns on incremental invested capital. Gruesome businesses are those that earn below their cost of capital and still strive for high growth, even though that requires significant sums of additional capital and destroys value.

The key to investing is not assessing how much an industry is going to affect society, or how much it will grow, but rather determining the competitive advantage of any given company and, above all, the durability of that advantage. — Warren Buffett

Investing is all about individual stocks and their economic characteristics. If you want to participate in the high growth rate of an industry that is characterized by poor profitability, do so indirectly through an ancillary industry that has better economics and lower competition (the best-case scenario would be if it's a monopoly business and the sole supplier to all players in the primary industry).

Buffett prefer a business that not only produces high returns on invested capital but also consistently reinvests a large portion of its earnings at similarly high returns. This is the holy grail of long-term value investing. A business has achieved true internal compounding power, which is the product of two factors: (1) return on incremental invested capital (ROIIC) and (2) the reinvestment rate. This compounding power leads to huge value creating over time. Typically, "compounding machines" enjoy a niche positioning or some durable competitive advantage that allows them to achieve high returns on capital for a long time.

The key to investing in these reinvestment moats lies in the conviction that the runway ahead for growth is long and that the competitive advantages that produce those high returns will sustain or strengthen over time.

Investors tend to confuse ROIIC with ROCE or ROIC. ROIIC less cost of capital drives value creation. In case of legacy moat businesses, the company's high ROIC reflects returns on prior invested capital rather than on incremental invested capital. In other words, a 20 percent reported ROIC today is not worth as much to an investor if no more 20 percent ROIC opportunities are available to reinvest the profits. Mature legacy moat businesses with good dividend yields may preserve one's capital, but they are not great at compounding wealth.

For example, if two businesses (Company A and Company B) have the same current ROIC of 20 percent, but Company A can invest twice as much as Company B at that 20 percent rate of return, then Company A will create much more value over time for its owners than Company B. Both of these companies will show up as businesses that produce 20 percent ROIC, but one is clearly superior to the other. Company A can reinvest a higher portion of its earnings, and thus it will create a lot more intrinsic value over time. The longer you own Company A, the wider gap grows between Company A's and Company B's investment result.

Valuation is more important over shorter time periods, quality along with growth is much more important over long time periods (seven to ten years and longer). The longer you hold a stock, the more the quality of that company matters. Your long-term returns will almost always approximate the company's internal compounding results over time.

It is far more important to invest in the right business than it is to worry about whether to pay 10x or 20x or even 30x for current-year earnings. Many mediocre businesses are available at less than 10x earnings that lead to mediocre results over time for long-term owners. The intrinsic value of quality business increases over time, thus increasing the margin of safety in the event of a stagnant stock price. This is a pleasant situation because it creates antifragility for an investor. In contrast, if a business is shrinking its intrinsic value, time is your enemy. You must sell it as soon as you can, because the longer you hold it, the less it is worth.

Investing is about identifying great businesses with high-quality earnings growth and capital allocation and firmly holding on to them as long as they exhibit these characteristics. The stock markets do not really matter over the long run when you invest in such businesses and, most importantly, stay the course.

Competitive advantage - The guiding principle of value creation is that companies create value by using capital they raise from investors to generate cash flows at rates of return exceeding the cost of capital. The faster companies can increase their revenues and deploy more capital at attractive rates of return, the more value they create. The combination of growth and return on invested capital (ROIC) relative to its cost is what drives value. Companies can sustain strong growth and high returns on invested capital only if they have a well-defined competitive advantage. Competitive advantages stem from various sources -

Intangible assets (such as brands, patents, and licenses)

Switching costs

Network effects

Low-cost advantages (from various sources, including process, scale, niche, and interrelatedness of new initiatives with existing lines of business)

Capitalism is brutal. Excess returns attract competition. Only a few rare businesses enjoy excess returns for many years by creating structural competitive advantages or economic moats. When investing in businesses that are widening the moat, with the passage of time, these businesses invariably turn out to be much cheaper than what would have resulted from our initial valuation work. When assessing the moat of any business, simply ask yourself how quickly a smart competitor with unlimited financial resources could replicate it. If your competitors know your success secret and still can't copy it, you have a strong moat.

Capital Allocation - is the bridge between intrinsic business value and shareholder value. If a company has high-return investment opportunities internally, it should reinvest heavily. When capital is deployed is ways that amplify value, shareholders benefit from both increased intrinsic business value and from value-accretive actions. Value compounds for shareholders. Great capital allocators can compensate for a lack of competitive advantage, and a great competitive advantage can compensate for poor capital allocation, including value-destroying M&A.

The market is efficient most, but not all, of the time

Benjamin Graham had said, "Basically, price fluctuations have only one significant meaning for the true investor. They provide him with with an opportunity to buy wisely when prices fall sharply and to sell wisely when they advance a great deal. At other times he will do better if he forgets about the stock market and pays attention to his dividend returns and to the operating results of his companies." If you can just adhere to these words throughout your investing career, you are bound to succeed.

The astonishing reality, however, is that the ever-present characteristics of greed and fear focus on short-term thinking, lack of patience, and the innate desire for instant gratification among market participants frequently lead to stock prices of even the large-cap blue-chip companies temporarily becoming grossly out of line with their underlying intrinsic value. Bull markets typically are fueled by cheap liquidity and usually come to an end with a sharp spike in interest rates. Buffett — In economics, interest rates act as gravity behaves in the physical world.

How to identify bull markets, from John Templeton - "Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria." Markets are driven by emotion. And sentiment, existing only in the minds of human beings, is subject to abrupt change without any notice. (The market is characterized by meta-randomness. Stocks are conditionally random on news. New is conditionally random on people. People are conditionally random on moods. Moods are conditionally random on mind-set). Trillions of moving parts are involved, so it is simply impossible for a single variable or even a handful of variables to tell us exactly when the good or bad times will end.

The real key to making money in stocks is not to get scared out of the,. Low- and negative-return years are a routine part of the investing game. You have to be present in this game for a long time to win. The key is to avoid getting thrown out midway because of reckless decisions.

The dynamic art of portfolio management and individual position sizing

Diversification is the best way to admit you have no idea what's going to happen in the future. It's how you prepare a portfolio for a wide range of future possibilities and admit your own infallibility. — Ben Carlson

However overdiversification tends to result in mediocre performance because the benefits of diversification start diminishing beyond a certain point. Statistical analysis shows that security-specific risk is adequately diversified after fourteen names in different industries, and the incremental benefit of each additional holding is negligible.

I decided to run a concentrated portfolio. As Joel Greenblatt pointed out, holding eight stocks eliminates 81 percent of the risk in owning just one stock, and holding thirty-two stocks eliminates 96 percent of the risk. This insight struck me as incredibly important. — David Einhorn

Phil Fisher believed in concentrating in about ten good investments and was happy with a limited number. That is very much in our playbook. And he believed in knowing a lot about the things he did invest in. And that's in our playbook, too. And the reason why it's in our playbook is that to some extent we learned it form him. — Charlie Munger

For individuals, any holding of over twenty different stocks is a sign of financial incompetence. — Phil Fisher

Avoid excessive diversification because risk lies in not knowing what you are doing.

The key to successful investing is to explicitly distinguish between fundamentals (i.e., the intrinsic value of the company based on expected future results) and market expectations (i.e., the stock price and the future results it currently is factoring in). Investing is all about expectations, and the outcomes are driven by revisions in expectations, which trigger changes in the stock price. Therefore, the ability to properly read market expectations and anticipate revisions of those expectations is the springboard for superior returns. To do this successfully, an investor needs to have "variant perception", that is, one must hold a well-founded view that is meaningfully different from the market consensus.

They key investing lesson is to make a few large bets infrequently. Look at lots of deals. Don't do almost all of them.

And the wise ones bet heavily when the world offers them that opportunity. They bet big when they have the odds. And the rest of the time, they don't. It's just that simple. — Warren Buffett

We should not aim for the highest possible returns in the shortest period of time but rather we should seek above-average returns over a long period of time with the lowest possible risk. Risk management should take a higher precedence in the investment process, and risk-adjusted returns are a far superior indicator of performance than absolute returns. If we continue to earn above-average returns over long periods of time and avoid permanent loss of capital in bear markets, the magic of long-term compounding ultimately will take of the outcome.

Investment Philosophy - An investment process is a set of guidelines that governs the behavior of investors in a way that allows them to remain faithful to the tenets of their personal philosophy. An intellectually sound and well-defined investment process helps investors stay the course during periods of underperformance or self-doubt and improves their chances of making prudent decisions with greater consistency across a full market cycle.

To make money, we need luck. To create wealth, we need consistency. Any investment strategy, however sound, will have periodic phases of underperformance. The solution is not to keep changing the strategy but rather to stick to it, with the understanding that discipline is the price to be paid for long-terms outperformance. Compounding is a lifelong journey, and an individual's impatience with his or her investment process could lead to a fatal decision and bring the journey to an abrupt end. Stay the course and remain faithful to your personal investment philosophy and your individual process. Focus is the key to success.

To finish first, you must first finish

All I want to know is where I'm going to die, so I'll never go there. — Charlie Munger If we can't tolerate a possible consequence, remote though it may be, we steer clear of planting its seeds.

Cash is a call option on opportunity. Having ample liquid cash puts a valuable optionality in the hands of investors, to make bargain purchases when opportunities arise, and it also makes them antifragile. It's one of the only price-stable assets that is simultaneously highly value-elastic: cash increases in value as other asset prices drop. The more they drop, the more valuable cash becomes. Conversely, if you are forced to sell assets in a market with a small number of buyers, you may end up taking large haircuts. So, how do you prevent this from happening to you? Have ample liquidity (cash reserves) so that you aren't forced to sell assets during periods of market turbulence and sharp drawdowns.

Ability to Take Risk = Assets — liability + Time

Having more assets, fewer future liabilities, and more time all increase your ability to take risk. You can't control the amount of time you have; however, time provides the opportunity to recoup losses, so more is better.

Charlie and I believe in operating with many redundant layers of liquidity, and we avoid any sort of obligation that could drain our cash in a material way. That reduces our returns in 99 years out of 100. But we will survive in the 100th while many others fail. And we will sleep well in all 100. — Warren Buffett

As an investor, how can you be best prepared to survive the inevitable periodic, severe corrections and bear markets during lifetime? Ensure that you have tennis balls (high-quality businesses) in your portfolio and not eggs (bad quality junk stocks) that will splatter after hitting the floor. In a market crash, both quality and junk fall. Quality eventually rises again and junk never recovers. Quality of business matters the most in retaining long-term wealth.

Market returns are largely clustered, followed by long periods of a ranged move. Volatility is often the greatest at turning points, diminishing as a new trend becomes established. Patience is extremely important. Beyond a certain point on a larger portfolio size, compounding becomes powerful. Long-term survival ensures a high probability of making money.

From an investor's point of view, staying power comes from a strong passion for the investing discipline; a constant learning mind-set; a long remaining investing life span; low or no personal debt; frugality; discipline; a sound understanding of human behavior, market history, and cognitive biases; a patient, long-term mind-set; and a supportive family whose importance is appreciated in a big way during the periodic rough times in the market.

Decision-Making

Be a business analyst, not a market, macroeconomics, or security analyst. — Charlie Munger

Whatever methods you use to pick stocks, your success will depend on your ability to ignore the worries of the world long enough to allow your stocks to succeed. No matter how intelligent you are, it isn't the head but the stomach that will determine your fate. — Peter Lynch

The pessimist sounds smart, but it is the optimist who makes money. Commerce is the fundamental backbone of civilization. When we invest in stocks, we participate in commerce and support its constant progress. Those who focus on this big picture prosper in the long run. Investors should learn from Buffett's thoughts on the critical importance of focusing on individual businesses and ignoring all of the noise around interest rate hikes, sharp spikes in inflation, stock market crashes, oil shocks, toppling f government regimes, depressions, and even full-blown wars.

Howard Marks wrote, in his memo to Oaktree clients in February 1993: "The average annual return on equities from 1926 to 1987 was 9.44 percent. But if you had gone to cash and missed the best 50 of those 744 months, you would have missed all of the return. This tells me that attempts at market timing are a source of risk, not protection." Time in the market matters, not timing the market. The ability to keep investing at regular intervals, to stay the course through thick and thin, ups and downs, and bull markets and bear markets, and to not worry where the markets are going tomorrow, or next week, or next month is what matters. Simple. — It's simple but not easy.

Be a keen student of financial history - there's nothing new in the world except the history you do not know. Those who cannot remember the past are condemned to repeat it. "The four most dangerous words in investing are 'This time, it's different.'"

Updating our beliefs in light of new evidence

The illiterate of the 21st century will not be those who cannot read and write, but those who cannot learn, unlearn, and relearn. It is not the strongest of the species that survive, nor the most intelligent, but the one the most responsive to change.

Psychologists consider this flexibility to be one of the key mental skills required to succeed along with other skills, such as creativity, critical thinking, and problem solving. Flexibility thinking is the ability to keep an open mind upon encountering new facts or situations and to be adaptive to changing a viewpoint from previously held thoughts or beliefs, however strongly held.

Good investing is a peculiar balance between the conviction to follow your ideas and the flexibility to recognize when you have made a mistake. You need to believe in something but, at the same time, you need to recognize that you will be wrong a considerable number of times over the course of your investing career. This fact holds true for all investors, regardless of their stature. The balance between confidence and humility is best learned through extensive experience and mistakes.

Understanding the true essence of compounding

Life is like a snowball. The important thing is finding wet snow and a really long hill. — Warren Buffett Understanding both the power of compound interest and the difficulty of getting it is the heart and soul of understanding a lot of things. — Charlie Munger

Our attitude determines our altitude. Honest mistakes are perfectly acceptable. But failing to learn from our mistakes is not acceptable. The key to learning from mistakes is to acknowledge them without excuses and to make the necessary changes to improve going forward.

You are not a product of your circumstances. You are a product of what you think. Happiness is all about the quality of thoughts you put in your head. Your thoughts influence your words and actions. Try to read or watch something productive or inspirational before going to sleep. The mind continues to process the last information consumed before bedtime, so you want to focus your attention on something constructive and helpful in making progress with your goals and ambitions. This ensures that you finish strong every day.

Compounding Good Health - To keep the body in good health is a duty, otherwise we shall not be able to keep our mind strong and clear.

Take care of your body. It's the only place you have to live. The motivating factor for taking care of your health should not be how long you live but how you are going to live in your old age. You should take care of your body as if it needs to serve you for a hundred years.

"The costs of your good habits are in the present. The costs of your bad habits are in the future." — James Clear

The food you eat can be either the most powerful form of medicine or the slowest form of poison. When it comes to food, always think nutrients, not calories.

Compounding Good Habits - What you are is what you have been. What you'll be is what you do now.

The compound effect is always in action, and it doesn't apply to money only. Intellectual and physical aptitudes behave similarly. A person who puts in continuous effort for ten years may achieve more in one week than someone who, having started six months ago, will achieve in an entire year.

When you improve a little each day, eventually big things occur. When you improve conditioning a little each day, eventually you have a big improvement in conditioning. Not tomorrow, not the next day, but eventually a big gain is made. Don't look for the big, quick improvement. Seek the small improvement one day at a time. That's the only way it happens —and when it happens, it lasts. — John Wooden

Compounding Wealth - The first thing to realize that it takes a long time. Accumulating money is a little like having a snowball going downhill; it's important to have a very long hill. It's important to work in sticky snow and you need a little snowball to start with. It's better if you're not in too much of a hurry and keep doing sound things. — Warren Buffett

Buffett has always considered the long-term game to be the best game. This circles back to his love for compound interest, which was so strong that when his wife, Susie, wanted to give charity, years ago, Buffett insisted on waiting, so that eventually the giveaway could be far greater. The greatest shortcoming of the human race is our inability to understand the exponential function.

The nice thing about investments is that knowledge accumulates on you and if you understand a business or industry once you are going to understand it for the next fifty years. When we compound knowledge, we advance not only ourselves but also the world at large. It takes a small individual action to kick-start a learning revolution.